Industrial Water Treatment Market Size to Worth USD 81.40 Bn by 2035

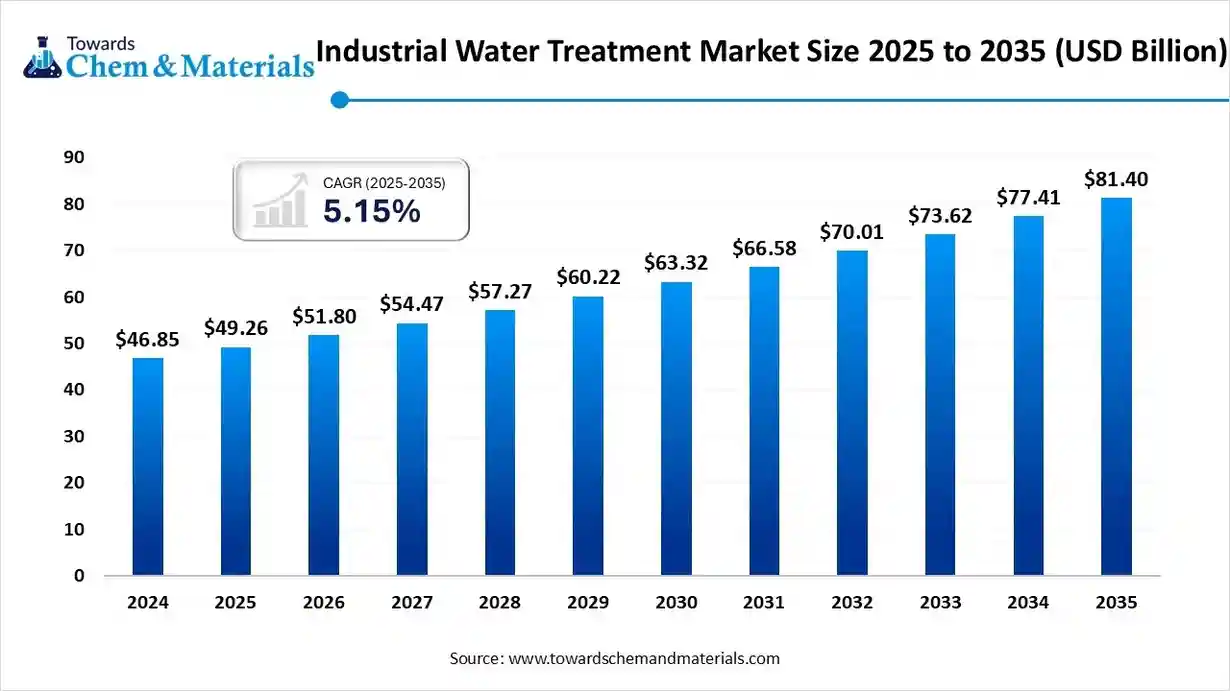

According to Towards Chemical and Materials, the global industrial water treatment market size is calculated at USD 49.26 billion in 2025 and is expected to be worth around USD 81.40 billion by 2035, growing at a CAGR of 5.15% from 2025 to 2035.

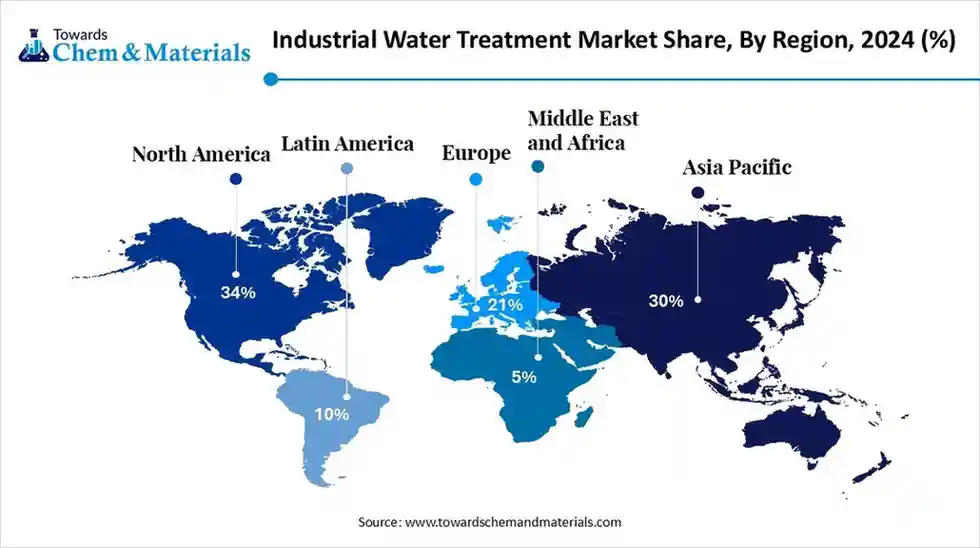

Ottawa, Nov. 11, 2025 (GLOBE NEWSWIRE) — The global industrial water treatment market size was valued at USD 46.85 billion in 2024 and is anticipated to reach around USD 81.40 billion by 2035, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period from 2025 to 2035. North America dominated the Industrial Water Treatment market with a market share of 34% in 2024. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5984

What is Industrial Water Treatment?

The global industrial water treatment market encompasses a wide range of technologies, chemicals, equipment, and services used by industries to treat water and wastewater so that it can be safely reused, discharged, or returned to the environment. The market is driven by increasing regulatory pressure, water reuse, and cost-effective solutions. Advanced technologies, including membranes, automation, digital monitoring, and zero liquid discharge systems, are becoming more prevalent as industries aim to optimise operations, reduce freshwater dependence, and comply with strict environmental norms.

Request Research Report Built Around Your Goals: [email protected]

Industrial Water Treatment Market Report Highlights

- North America dominated the industrial water treatment market and accounted for the largest revenue share of 34% in 2024.

- By product type, the equipment & systems segment accounted for the largest revenue share of 40% in 2024.

- By technology type, the membrane separation segment held the largest revenue share of 30% in 2024.

- By end user industry, the power & utilities segment accounted for the largest revenue share of around 22% in 2024.

- By deployment, the on-site / engineered, fixed installations segment dominated the market with a share of 78% in 2024

- By distribution channel type, the direct sales/ OEM accounts segment held the largest market share of 55% in 2024.

- The Top companies profiled, Veolia; Ecolab Inc.; Xylem; Pentair; Kurita Water Industries Ltd.; Solenis; SWA Water Australia; WOG GROUP; Kemira; Feralco AB

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5984

Industrial Water Treatment Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 51.80 Billion |

| Revenue forecast in 2035 | USD 81.40 Billion |

| Growth rate | CAGR of 5.15% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2021 – 2025 |

| Forecast period | 2025 – 2035 |

| Segments covered | By Product Type, By Technology / Process, By End-User Industry, By Deployment Type, By Sales / Distribution Channel, By Region |

| Region scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key companies profiled | Veolia; Ecolab Inc.; Xylem; Pentair; Kurita Water Industries Ltd.; Solenis; SWA Water Australia; WOG GROUP; Kemira; Feralco AB |

For more information, visit the Towards Chemical and Materials website or email the team at [email protected]| +1 804 441 9344

What are the main processes used to treat wastewater?

Wastewater treatment aims to remove solids and organic matter as well as targeted pollutants, depending on the nature of the water and the discharge point.

- Biological processes are based on bacteria which consume the organic matter contained in wastewater. The design of the biological process will consider the removal rates of these bacteria and their kinetics. The bacteria can either be free in the water (in the case of activated sludge) or fixed on media in the case of biofilm-based processes. The latter can be significantly more compact while also being more robust.

- Physical-chemical processes are also used in wastewater treatment. These include pre-treatment at the plant inlet, grids, grit removal, oil removal and primary settling, secondary settling, membranes in the case of a membrane bioreactor, and tertiary settling or filtration, used to refine the performance in terms of solids and phosphorus removal. An adsorption system, for example, can then tackle micropollutants and emerging compounds (pharmaceuticals, hormones, etc.).

The Key Industrial Water Treatment Market Company Insights

Some of the key players operating in the market include Veolia and Ecolab Inc. among others.

- Veolia is a global leader in water, waste, and energy management, with a dominant presence in the industrial water treatment industry. Through its water technologies division, Veolia offers cutting-edge solutions such as wastewater reuse, zero liquid discharge (ZLD), and process water treatment systems tailored to sectors like energy, pharmaceuticals, and food & beverage. The company’s proprietary technologies enhance operational efficiency while meeting stringent environmental standards. Veolia’s global footprint and commitment to sustainability position it as a critical player in driving circular water economy solutions across industrial sectors.

- Ecolab Inc. is a prominent provider of water, hygiene, and energy technologies, offering comprehensive industrial water treatment solutions through its Nalco Water division. Ecolab Inc. delivers advanced programs for boiler, cooling, and wastewater systems, integrating real-time monitoring tools to improve performance and conserve resources. Ecolab’s focus on digitalization, predictive analytics, and sustainability has made it a trusted partner for industries aiming to reduce water usage, improve operational reliability, and comply with environmental regulations.

SWA Water Australia and WOG GROUP are some of the emerging market participants in the industrial water treatment industry.

- SWA Water Australia is an emerging player in the industrial water treatment industry, known for its expertise in designing and manufacturing custom-built treatment systems. The company specializes in oil-water separation, dissolved air flotation (DAF), and wastewater recycling technologies suited for sectors such as mining, petrochemicals, and food processing. With a strong regional presence and a focus on modular, cost-effective systems, SWA Water Australia is gaining traction among clients seeking efficient and adaptable water treatment solutions in remote or resource-intensive operations.

- WOG GROUP is an emerging global water treatment solutions provider with growing relevance in industrial markets. The company offers a broad portfolio including effluent treatment plants (ETPs), sewage treatment plants (STPs), and zero liquid discharge (ZLD) systems, catering to industries like textiles, chemicals, and oil & gas. WOG GROUP emphasizes turnkey project execution, integrating engineering, procurement, and construction (EPC) capabilities. Its increasing involvement in decentralized water treatment and commitment to eco-friendly technologies make it a rising force in the evolving industrial water treatment industry.

What Are the Major Trends in the Wastewater Treatment Services Market?

- Increasing adoption of advanced treatment technologies such as membrane separation, electrochemical, and advanced oxidation and zero-liquid discharge systems, driven by stricter standards and the need for high-purity effluent.

- Growing emphasis on sustainability and circular economy models, including water reuse, recovery of treatment by-products, and use of bio-based/low-toxicity chemicals in services.

- Digitalisation and automation of service offerings integrating IoT, real-time monitoring, AI-driven dosing, and analytics to optimise operation, reduce chemical use, and lower costs.

- Expansion in emerging regions where industrialisation, urbanisation, and water scarcity are creating strong demand for outsourced wastewater treatment services.

- Service providers are moving from purely reactive maintenance models to outcome-based contracts and integrated solutions.

How Does AI Influence the Growth of the Industrial Water Treatment Industry in 2025?

The integration of artificial intelligence (AI) into industrial water treatment is reshaping how the sector approaches efficacy and sustainability. AI-driven systems enable real-time monitoring of water quality and treatment processes by analysing vast sets of sensor and operational data, allowing plants to dynamically adjust chemical dosing, flow rates, and energy consumption to match actual conditions. As a result, treatment facilities are becoming more agile, responsive, and cost-effective, with fewer manual interventions and better alignment with regulatory and environmental requirements.

Looking ahead into 2025, AI’s role in the industrial water treatment Industry is poised to accelerate growth by unlocking value across operations. Predictive analytics are helping identify maintenance needs and potential faults in equipment before failure occurs, reducing downtime and extending asset life.

Invest in Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5984

Why Industrial Water Treatment Is Business Critical?

Water is a fundamental resource for numerous industrial processes—whether manufacturing, food processing, power generation, pharmaceuticals, or textiles. Yet, industries are also among the largest consumers and polluters of freshwater. As environmental regulations tighten and resource scarcity rises, industrial water treatment is no longer a compliance checkbox—it’s a business-critical necessity.

From ensuring operational efficiency to protecting brand reputation and the environment, effective treatment of industrial wastewater is central to sustainable business practices. Here’s a deep dive into why investing in industrial water treatment isn’t just responsible—it’s smart business.

The Role of Industrial Water Treatment

Industrial water treatment refers to the processes used to make water suitable for industrial applications or safe for discharge into the environment. It typically involves removing impurities, adjusting pH levels, softening water, or treating hazardous chemicals, depending on the nature of the industry.

Industries rely on water for various operations, including cooling, heating, cleaning, and as a raw material. However, untreated or poorly treated water can damage equipment, slow production, and cause environmental harm. That’s where industrial water treatment plants come into play, acting as critical assets in a company’s infrastructure.

Why Is Industrial Waste Water Treatment So Important?

The discharge from industries often contains contaminants such as heavy metals, oils, chemicals, and organic matter. If not treated properly, these pollutants can harm aquatic ecosystems, contaminate drinking water sources, and violate regulatory norms.

Key reasons why industrial wastewater treatment is critical:

- Regulatory Compliance

Environmental authorities around the world are imposing stricter discharge standards. Non-compliance can lead to hefty fines, shutdowns, and legal liabilities. - Resource Optimization

Water recycling and reuse reduce dependency on fresh water, especially in water-scarce regions. Treated water can be reused for cooling towers, cleaning, or even irrigation. - Public and Stakeholder Trust

Responsible water management enhances a company’s environmental, social, and governance (ESG) profile, boosting investor confidence and public perception. - Cost Efficiency

Preventing corrosion, scaling, and fouling through proper treatment reduces equipment maintenance costs and unplanned downtime. - Environmental Responsibility

As climate change and pollution threats escalate, treating industrial effluents is a key part of reducing a company’s environmental footprint.

Role of Industrial Water Treatment Plant Manufacturers

Given the specialized nature of water treatment needs across industries, industrial water treatment plant manufacturers play a crucial role in designing, engineering, and maintaining robust solutions.

Trusted manufacturers offer:

- Custom plant design based on water quality and industry application

- Turnkey project execution and installation

- Integration of automation and real-time monitoring systems

- Supply of high-quality industrial water treatment chemicals

- Ongoing maintenance, training, and upgradation services

Choosing the right manufacturer ensures that the treatment system is scalable, sustainable, and cost-effective in the long run.

Industrial Water Treatment Market Segmentation Insights

Product Type Insights:

Why the Equipment and Systems Segment Dominated the Industrial Water Treatment Market?

The equipment and systems segment dominated the market in 2024. This segment includes filters, membranes, pumps, and treatment units that form the core of industrial water treatment infrastructure. The dominance of this segment is attributed to the widespread adoption of physical and mechanical treatment equipment across industries such as power, oil and gas, manufacturing, and pharmaceuticals. Companies are investing heavily in modern systems that enhance operational reliability, reduce maintenance frequency, and meet tightening discharge standards.

The digital monitoring, automation, and analytics segment is projected to expand rapidly in the coming years. Industries are increasingly relying on digital tools to optimize water treatment operations and gain real-time insights into system performance. Automation and analytics enable predictive maintenance, reduce manual intervention, and improve resource efficiency, factors that are transforming the traditional water treatment landscape.

Technology Type Insights:

Which Technology Segment Held the Dominating Share of the Industrial Water Treatment Market in 2024?

The membrane separation segment dominated the market in 2024. Membrane technologies such as microfiltration, ultrafiltration, and reverse osmosis are widely used for their high efficiency in removing contaminants and enabling water reuse. Industrial facilities prefer membrane systems due to their compact design, modular scalability, and ability to produce consistent, high-quality water. The push for resource conservation, coupled with stricter discharge standards, has made membrane separation a preferred solution across industries like pharmaceuticals, food processing, and power generation.

The electrochemical and advanced oxidation segment is expected to grow at the highest rate during 2025-2035. These emerging technologies offer effective removal of persistent pollutants, organic matter, and heavy metals that traditional methods struggle to treat. Their ability to degrade contaminants without generating harmful by-products makes them appealing for industries seeking sustainable and eco-friendly solutions.

End-User Industry Insights:

How did the Power & Utilities Segment Hold the Largest Share of the Industrial Water Treatment Market in 2024?

The power & utilities segment dominated the market in 2024. Power generation plants require vast amounts of treated water for cooling, steam generation, and equipment maintenance, making water management critical to operational reliability. With rising electricity demand for gaining infrastructure, utilities are prioritizing modern treatment systems to ensure efficiency and regulatory compliance. This shift toward sustainable power generation, including the integration of renewable energy, further drives investment in advanced water purification and recycling systems.

The semiconductor/electronics segment is projected to experience the highest growth rate from 2025 to 2035. This industry demands ultrapure water for chip fabrication and other precision processes, necessitating sophisticated treatment systems capable of removing microscopic contaminants. Rapid expansion of semiconductor manufacturing across Asia and North America has accelerated the deployment of high-grade water purification and wastewater recovery units in electronics and semiconductor industry.

Deployment Insights:

Which Deployment Leads the Industrial Water Treatment Market?

The on-site/engineered fixed installations segment dominated the market in 2024. Large industrial facilities often prefer fixed installations due to their high treatment capacity, customization potential, and term cost efficiency. These systems are designed to meet complex industrial needs, providing consistent water quality and compliance with stringent environmental standards. Industries with continuous operations, such as refineries, power plants, and chemical manufacturers, depend heavily on these systems to ensure uninterrupted performance.

The packaged/modular/skid-mounted systems segment is projected to expand rapidly in the coming years. These systems offer portability, scalability, and faster setup times, making them ideal for small to mid-sized industrial sites and temporary operations. As industries seek cost-effectiveness, flexible solutions engagement allows for localized treatment, and modular systems are emerging as a preferred choice. They also enable decentralized treatment, allowing multiple smaller facilities to operate efficiently without large infrastructure investments.

Distribution Channel Type Insights:

What made the direct sales/ OEM accounts segment Dominate the Industrial Water Treatment Market?

The direct sales/ OEM accounts segment dominated the market in 2024. Direct engagement allows manufacturers to build long-term relationships with industrial clients and provide tailored technical support and maintenance services. Large corporations prefer OEM partnerships to ensure reliability, customization, and integration of advanced systems. This approach enhances transparency, customer loyalty, and consistent after-sales service. The direct sales model remains the backbone of the industry, sustaining trust and ensuring the delivery of high-quality, application-specific solutions.

The online/digital marketplaces & e-channels segment is expected to grow rapidly between 2025 and 2035. The digital transformation of procurement is changing how industries source treatment chemicals, components, and services. E-channels and online platforms offer transparency, price comparison, and quick access to global suppliers, appealing to both large and mid-sized buyers. The expanding market accessibility. This trend reflects the sector’s broader movement toward digitization and smarter supply chain management.

Regional Insights

Why Is North America Dominating the Industrial Water Treatment Market?

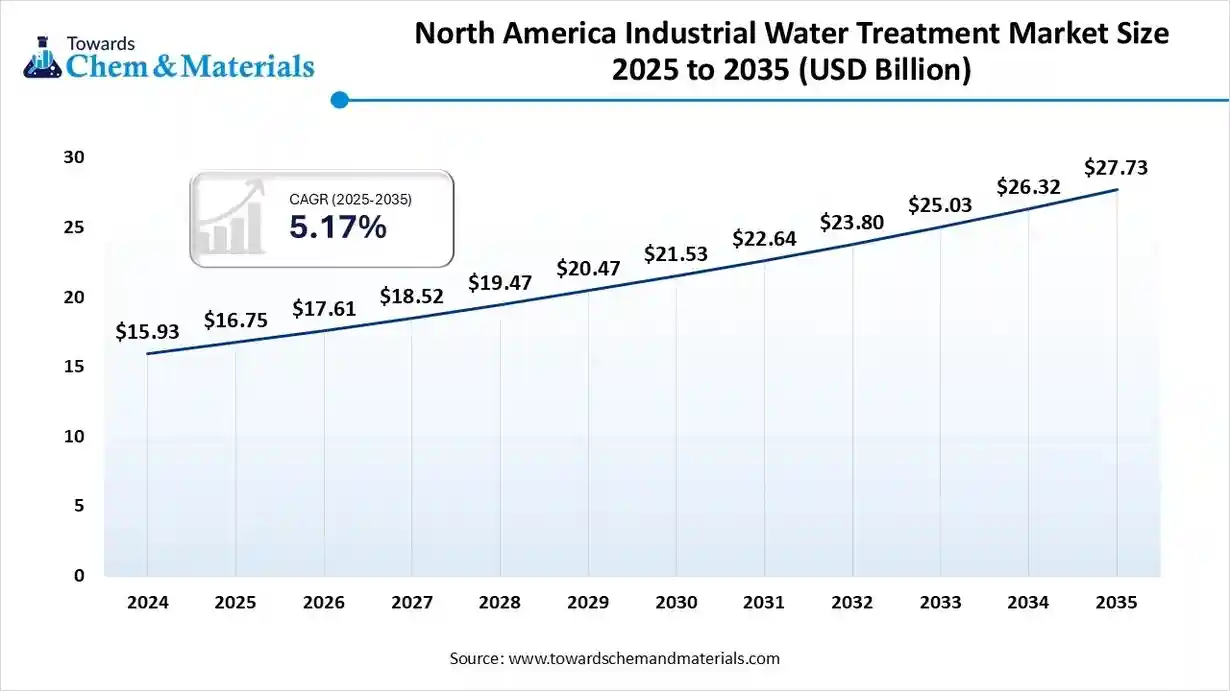

The North America industrial water treatment market size was valued at USD 16.75 billion in 2025 and is expected to reach USD 27.73 billion by 2035, growing at a CAGR of 5.17% from 2025 to 2035. North America dominated the industrial water treatment market with a 34% industry share, owing to the heavy sustainability regulations implementation and having access to advanced water treatment facilities in the current period.

The North America region dominated the market in 2024, thanks to its mature industrial base, advanced water treatment infrastructure, and strong regulatory environment that drives demand for solutions and services. With high-value industries such as power generation, oil and gas, and chemicals significantly reliant on efficient water management, the region’s treatment market benefits from ongoing investments in upgrades and sustainability initiatives.

U.S. Industrial Water Treatment Market Trends:

Within North America, the U.S. has stood out as the primary market due to its large industrial footprint, stringent environmental protection rules, and emphasis on technology-driven solutions in water treatment systems. The country’s regulatory landscape, combined with significant investment capacity and demand from sectors such as large-scale manufacturing and energy mining, continues to ensure that the U.S. holds a central role in shaping the broader regional market.

Why Is Asia Pacific the Growing Market?

Asia Pacific is expected to grow at the fastest rate from 2025 to 2035. The Asia Pacific region is rapidly gaining prominence in the industrial water treatment sector due to swift industrialization, urban expansion, and rising demand for treated water in both manufacturing and utilities. The region is also implementing stronger environmental norms and policies that compel industries to upgrade or install efficient treatment systems, boosting market momentum.

China Industrial Water Treatment Market Trends

Within the Asia Pacific, China stands out as the major country driving market growth for industrial water treatment thanks to its large industrial base, stringent effluent and reuse mandates, and major investment in water infrastructure upgrades. These factors combine to position China as a dominant contributor to both demand and technological adoption in the regional market.

Europe Industrial Water Treatment Market Trends

The Europe industrial water treatment industry is expected to grow at a CAGR of over 4.11% from 2025 to 2035. In Europe, the market is driven by the region’s strong regulatory framework focused on environmental protection, water conservation, and circular economic principles. Rising concerns over water scarcity in Southern Europe and the need for sustainable water reuse in manufacturing and energy sectors are also accelerating market demand. The presence of global water technology leaders and active collaboration between public and private sectors further supports innovation and long-term growth in the regional industrial water treatment industry.

The UK industrial water treatment industry is expected to grow at a significant rate in the coming years. The market is being driven by stringent environmental regulations imposed by agencies such as the Environment Agency (EA) and increasing pressure on industries to reduce water pollution and enhance sustainability practices. The UK’s strong focus on achieving net-zero carbon emissions by 2050 is encouraging the adoption of energy-efficient water treatment technologies. The country’s advanced research capabilities further promote the development of innovative treatment solutions across the industrial water treatment industry.

The Germany industrial water treatment industry is driven by the country’s robust industrial infrastructure and stringent environmental regulations. The country’s strong push toward the circular economy and resource-efficient production is promoting water recycling and zero-liquid-discharge systems. Government-backed initiatives under Germany’s Energy Efficiency Strategy for Industry and the broader Industry 4.0 framework are further accelerating the adoption of smart, automated, and energy-efficient industrial water treatment solutions across industrial facilities.

Top Companies in the Industrial Water Treatment Market & Their Offerings:

Tier 1:

- Veolia Environnement: Veolia provides end-to-end industrial water and wastewater solutions focused on resource recovery, energy efficiency, and compliance.

- SUEZ: SUEZ offers innovative solutions for designing, building, and maintaining industrial water treatment facilities, specializing in water reuse, desalination, and resource recovery.

- Xylem Inc.: Xylem provides a broad portfolio of industrial water technology products and services, including advanced filtration and disinfection systems, to improve efficiency and sustainability.

- DuPont (Water-related business / Membranes & chemicals): DuPont is a leader in separation and purification technologies, supplying high-performance membranes and ion exchange resins for industrial water production and reuse.

- Pentair plc: Pentair delivers a variety of industrial water treatment solutions, including filtration, separation, and flow technologies, to improve water quality and optimize processes.

- Kurita Water Industries Ltd.: Kurita specializes in comprehensive water treatment solutions, offering chemicals, equipment, and services to maximize efficiency and minimize environmental impact.

- Evoqua Water Technologies: Evoqua provides a wide array of water and wastewater treatment systems and services, focusing on advanced biological treatment, filtration, and disinfection technologies for industrial customers.

- WABAG (VA Tech Wabag Ltd.): WABAG focuses on the design, build, and operation of water and wastewater treatment plants and desalination facilities for both municipal and industrial clients.

- Thermax Ltd.: Thermax offers a range of industrial water and wastewater treatment solutions, including ion exchange and membrane systems, with an emphasis on sustainable solutions for heating, cooling, and power processes.

More Insights in Towards Chemical and Materials:

- Water and Wastewater Treatment Market : The water & wastewater treatment market size is calculated at USD 348.19 billion in 2024, grew to USD 371.00 billion in 2025, and is projected to reach around USD 656.68 billion by 2034. The market is expanding at a CAGR of 6.55% between 2025 and 2034.

- Industrial Water Treatment Chemical Market : The global industrial water treatment chemicals market size is estimated at USD 18.84 billion in 2025, it is predicted to increase from USD 19.89 billion in 2026 to approximately USD 32.34 billion by 2035, expanding at a CAGR of 5.55% from 2025 to 2035.

- Packaged Wastewater Treatment Market : The global packaged wastewater treatment market size accounted for USD 31.54 billion in 2025 and is predicted to increase from USD 34.34 billion in 2026 to approximately USD 73.66 billion by 2035, growing at a CAGR of 8.85% from 2025 to 2035.

- Produced Water Treatment Market : The global produced water treatment market size is calculated at USD 11.05 billion in 2025 and is predicted to increase from USD 11.58 billion in 2026 and is projected to reach around USD 17.58 billion by 2035, The market is expanding at a CAGR of 4.75% between 2025 and 2035.

- Water Treatment Systems Market : The global water treatment systems market size is calculated at USD 46.07 billion in 2025 and is predicted to increase from USD 50.10 billion in 2026 and is projected to reach around USD 106.50 billion by 2035, The market is expanding at a CAGR of 8.74% between 2025 and 2035.

- Wastewater Treatment Services Market : The global wastewater treatment services market size is estimated at USD 67.56 billion in 2025, it is predicted to increase from USD 72.22 billion in 2026 to approximately USD 131.78 billion by 2035, expanding at a CAGR of 6.91% from 2025 to 2035.

- Petrochemical Market : The global petrochemicals-market size was valued at USD 659.55 billion in 2024, grew to USD 700.05 billion in 2025, and is expected to hit around USD 1,196.85 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.14% over the forecast period from 2025 to 2034.

- Textile Chemicals Market : The global textile chemicals market volume is expected to produce approximately 1.52 million tons in 2025, with a forecasted increase to 2.46 million tons by 2034, growing at a CAGR of 5.49% from 2025 to 2034.

- Textile Market : The textile market size was estimated at USD 1.33 trillion in 2024 and grew to USD 1.39 trillion in 2025, and is projected to reach around USD 2.01 trillion by 2034. The market is expanding at a CAGR of 4.24% between 2025 and 2034.

- Europe Textile Market : The Europe textile market size was reached at USD 260.85 Billion in 2024 and is expected to be worth around USD 410.94 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.65% over the forecast period 2025 to 2034.

- Geotextiles Market : The global geotextiles market size accounted for USD 10.89 billion in 2025 and is predicted to increase from USD 12.01 billion in 2026 to approximately USD 28.90 billion by 2035, growing at a CAGR of 10.25% from 2025 to 2035.

- North America Water and Wastewater Treatment Market : The North America water and wastewater treatment market size is estimated at USD 111.32 billion in 2025 it is predicted to increase from USD 118.64 billion in 2026 and is projected to reach USD 210.35 billion by 2035, growing at a CAGR of 6.57% from 2025 to 2035.

- Oil & Gas Market : The global Oil & Gas-market size was valued at USD 6.10 Trillion in 2024, grew to USD 6.33 Trillion in 2025, and is expected to hit around USD 8.79 Trillion by 2034, growing at a compound annual growth rate (CAGR) of 3.72% over the forecast period from 2025 to 2034.

- Oil & Gas Infrastructure Market : The global oil & gas infrastructure market size was reached at USD 752.19 billion in 2024 and is expected to be worth around USD 1,377.87 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.24% over the forecast period 2025 to 2034.

- Europe Water and Wastewater Treatment Market : The Europe water and wastewater treatment market size is estimated at USD 93.31 billion in 2025, is projected to grow to USD 99.45 billion in 2026, and is expected to reach around USD 176.48 billion by 2035. The market is expanding at a CAGR of 6.58% between 2025 and 2035.

- U.S. Water and Wastewater Treatment Market : The U.S. water and wastewater treatment market size was accounted for USD 121.85 billion in 2024 and is predicted to increase from USD 130.31 billion in 2025 to approximately USD 238.36 billion by 2034, expanding at a CAGR of 6.94% from 2025 to 2034.

- Water Treatment Polymers Market : The global water treatment polymers market volume was valued at 8,323.10 kilotons in 2024 and is estimated to reach around 15,477.50 kilotons by 2034, exhibiting a compound annual growth rate (CAGR) of 6.40% during the forecast period 2025 to 2034.

Industrial Water Treatment Market Top Key Companies:

- Veolia

- Ecolab Inc.

- Xylem.

- Pentair.

- Kurita Water Industries Ltd.

- Solenis

- SWA Water Australia

- WOG GROUP

- Kemira

- Feralco AB

Recent Developments

- In May 2025, Veolia announced its acquisition of full ownership of its Water Technologies and Solutions unit by purchasing the remaining stake from CDPQ. This strategic move enhances Veolia’s leadership in the industrial water treatment industry, enabling the company to fully integrate operations and accelerate innovation. By consolidating control, Veolia is positioned to provide more efficient and sustainable water treatment technologies and services, supporting critical industries and reinforcing its growth trajectory in this vital market.

- In March 2025, Ecolab Inc. reinforced its leadership in industrial water treatment by leveraging AI-driven water conservation solutions to optimize water use, reduce environmental impact, and enhance operational efficiency across various industries. Collaborating with key partners, Ecolab’s innovative AI-powered systems enable real-time monitoring and predictive analytics that improve water reuse and extend equipment lifespan. These advancements are driving significant progress in the industrial water treatment industry.

- In August 2024, Nalco Water, an Ecolab Inc. company, and Danieli announced a strategic collaboration to enhance industrial water treatment for the metals industry. By combining Nalco Water’s chemical and service expertise with Danieli’s technological capabilities, the partnership aims to improve production processes, reduce carbon and water footprints, and boost plant performance and reliability. This initiative leverages digitally enabled solutions to optimize water management, lower operational costs, and support sustainable manufacturing practices in the market.

- In September 2025, A start-up incubated at IIT Madras reported a successful installation of a next-generation wastewater treatment system named BADS at industrial units in Erode district. This system delivers energy recovery, carbon reduction benefits, and cost savings for industries tackling complex wastewater streams.

- In August 2025, researchers at Shiv Nadar University in India developed a biochar-infused membrane made from spice residue and tannery sludge that can remove dyes and antibiotics from industrial wastewater and be reused multiple times, offering a sustainable treatment alternative.

Industrial Water Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Industrial Water Treatment Market

By Product Type

Equipment & Systems (membranes, filters, pumps, ZLD units, desalination units)

- Reverse osmosis / NF / UF membrane systems

- Sand/multimedia filtration

- Pumps, valves, control hardware

- Thermal desalination/evaporators / ZLD

- Pretreatment skids / modular units

Water Treatment Chemicals & Consumables (antiscalants, biocides, coagulants, polymers, corrosion inhibitors)

- Antiscalants & antifoulants

- Biocides/disinfectants

- Coagulants & flocculants

- Corrosion/scale inhibitors

Operation & Maintenance (O&M) services

- Long-term O&M contracts

- Site labor & consumables management

Digital Monitoring, Automation & Analytics (IoT, SaaS, remote monitoring)

- Remote sensors & telematics

- Cloud analytics / predictive maintenance

- Spare Parts & Aftermarket

- Other (rental, temporary/mobile treatment)

By Technology / Process

- Membrane Separation (RO / NF / UF)

- Biological Treatment (activated sludge, MBBR, SBR)

- Physical / Chemical Treatment (coagulation, flocculation, conventional filtration)

- Ion Exchange & Adsorption (activated carbon, specialty media)

- Thermal Processes (evaporation, multi-effect evaporators, distillation for ZLD)

- Electrochemical & Advanced Oxidation (AOP, electrocoagulation)

- Other / Niche (constructed wetlands, emerging tech)

By End-User Industry

Power & Utilities (boiler feed, cooling, flue gas desulfurization make-up)

- Oil & Gas / Petrochemical

- Chemicals & Pharmaceuticals

- Food & Beverage

- Metals & Mining

- Semiconductor & Electronics (process & ultra-pure water)

- Pulp & Paper

- Textile

- Other industrial end-users

By Deployment Type

- On-site / Engineered, fixed installations

- Packaged / Modular / Skid-mounted systems

- Cloud-native / digital-only solution subscriptions

- Mobile / Temporary treatment units

By Sales / Distribution Channel

- Direct sales / OEM accounts

- Distributors & regional dealers

- EPC contractors/system integrators (project channel)

- Aftermarket / Service providers

- Online/digital marketplaces & e-channels

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5984

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: [email protected]

Web: https://www.towardschemandmaterials.com/

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. DailyIndiaNews.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. DailyIndiaNews.com takes no editorial responsibility for the same.