Financial Risk Management Software Market to Hit USD 12.91 Billion by 2033, Driven by Regulatory Compliance and Industry Volatility | SNS Insider

The financial risk management software market is expanding as institutions adopt AI-driven and real-time risk analytics, with the U.S. segment growing from USD 1.36 billion in 2025E to USD 4.05 billion by 2033 amid increasing regulatory and risk management demands.

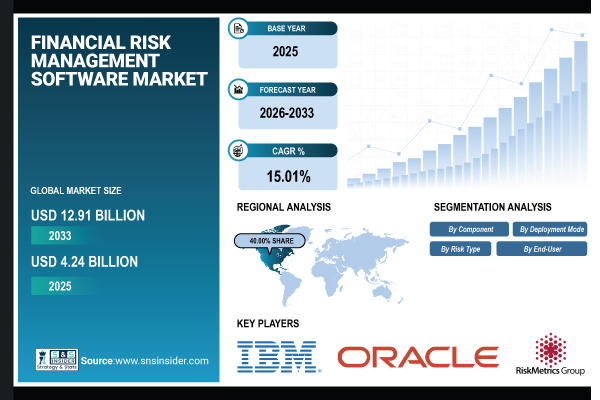

Austin, Jan. 17, 2026 (GLOBE NEWSWIRE) — The global Financial Risk Management Software Market is valued at USD 4.24 billion in 2025E and is expected to reach USD 12.91 billion by 2033, growing at a CAGR of 15.01% from 2026 to 2033.

Growing exposure to credit, operational, and cyber risks, as well as increased market volatility and regulatory compliance requirements, are the main factors propelling the financial risk management software industry’s expansion.

Download PDF Sample of Financial Risk Management Software Market @ https://www.snsinsider.com/sample-request/9285

U.S. financial risk management software market is valued at USD 1.36 billion in 2025E and is expected to reach USD 4.05 billion by 2033, growing at a CAGR of 14.72% during the forecast period.

Stricter regulatory compliance requirements, expanding cybersecurity and fraud threats, and rising financial market volatility are all contributing factors to the growth of the U.S. financial risk management software market.

Segmentation Analysis:

By Component

Software led with 48.5% share as it forms the core of risk management solutions, offering modules for credit, market, operational, and enterprise risk. Support & Maintenance is the fastest-growing segment with CAGR of 18.2% due to increasing reliance on third-party technical support, system upgrades, and managed services.

By Deployment Mode

On-Premises led with 42.7% share due to high adoption among large banks and financial institutions that require complete control over data security, compliance, and system customization. Cloud-Based is the fastest-growing segment with CAGR of 20.3% driven by digital transformation, remote accessibility, and scalable infrastructure.

By Risk Type

Credit Risk Management led with 36.8% share as it is critical for monitoring borrowers’ financial health and preventing defaults. Operational Risk Management is the fastest-growing segment with CAGR of 18.9% due to increasing need for managing process, technology, and human errors across financial organizations.

By End-User

Banks & Financial Institutions led with 44.3% share as they are the primary users of FRM software for compliance, portfolio management, credit assessment, and market risk monitoring. Corporate Enterprises is the fastest-growing segment with CAGR of 19.4% as non-financial organizations increasingly adopt FRM software to monitor market, operational, and liquidity risks.

If You Need Any Customization on Financial Risk Management Software Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/9285

Regional Insights:

North America dominated the Financial Risk Management Software Market with a 40.00% share in 2025 due to the presence of leading financial institutions, advanced IT infrastructure, and strong adoption of sophisticated risk management tools.

Asia Pacific is expected to grow at the fastest CAGR of about 21.06% from 2026–2033, driven by rapid digital transformation in banking and financial services, increasing adoption of cloud-based risk solutions, and rising awareness of regulatory compliance.

Increasing Regulatory Compliance Requirements and Stringent Risk Management Standards are Boosting Market Expansion Globally

To reduce financial risks, governments and regulatory agencies around the world have implemented strict compliance standards, such as Basel III, IFRS 9, and Dodd-Frank rules. There is growing pressure on organizations to effectively monitor, report, and manage credit, market, and operational risks. Institutions can track risk exposure in real time, automate compliance reporting, and stay transparent with regulators thanks to financial risk management (FRM) software. The increasing intricacy of financial rules has sped up the use of FRM software, which helps banks and businesses make better decisions, lower regulatory penalties, and preserve operational resilience in international markets, all of which contribute to the expansion of the market as a whole.

Key Players:

- IBM

- Oracle

- SAP

- SAS Institute

- Experian

- FIS Global

- Moody’s Analytics

- Murex

- IHS Markit

- RiskMetrics Group

- Thomson Reuters

- S&P Global

- Wolters Kluwer

- Misys

- Kyriba

- Active Risk

- Pegasystems

- Resolver

- MetricStream

- LogicManager

Buy Full Research Report on Financial Risk Management Software Market 2026-2033 @ https://www.snsinsider.com/checkout/9285

Recent Developments:

March 2024, IBM launched IBM Risk Analytics for Finance, a cloud-native suite powered by watsonx.ai and watsonx.data, designed for real-time financial risk modeling and scenario analysis.

October 2023, Oracle enhanced its Financial Services Risk Management Cloud, offering a unified platform for credit, market, liquidity, and operational risk fully integrated with Oracle Fusion Cloud ERP and Banking.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. DailyIndiaNews.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. DailyIndiaNews.com takes no editorial responsibility for the same.