Trends and Demand in Biofoam Packaging Market 2025-35

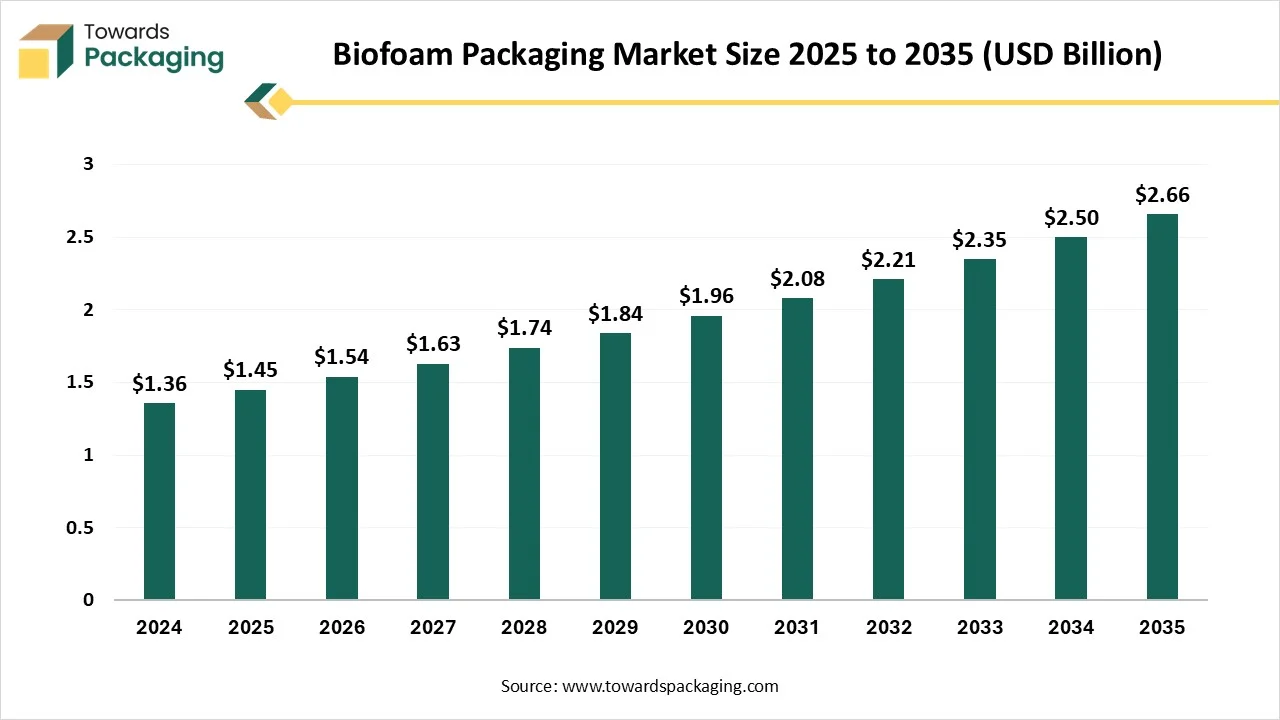

As highlighted by Towards Packaging research, the global biofoam packaging market, valued at USD 1.45 billion in 2025, is expected to reach USD 2.66 billion by 2034, registering a CAGR of 18.5% throughout the forecast period.

Ottawa, Jan. 19, 2026 (GLOBE NEWSWIRE) — The global biofoam packaging market was valued at USD 1.45 billion in 2025 and is expected to grow to USD 2.66 billion in 2034, as noted in a study published by Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: [email protected]

Key Technological Shifts

- Development of bio-based polymers (e.g., PLA, PHA, starch blends) replacing petroleum-derived foams.

- Innovations in expanded biofoam processing to improve insulation and shock absorption.

- Use of nano-cellulose and bio-fillers to enhance mechanical strength and barrier properties.

- Advances in enzymatic and microbial foaming processes for cleaner production

- Integration of compostable additives that accelerate biodegradation in industrial and home composting.

- Enhanced thermal and moisture resistance technologies to expand applications in food and temperature-sensitive goods.

Market Overview

The biofoam packaging market is expanding as producers and consumers move from conventional foam materials and toward low-impact biodegradable alternatives. Demand from the food e-commerce and consumer goods industries that prioritize sustainability drives growth. Performance and adoption are being improved by technological developments in bio-based polymers and processing.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5878

Major Government Initiatives for the Biofoam Packaging Industry:

- Packaging and Packaging Waste Regulation (PPWR) 2025 (EU): This landmark regulation, which entered into force in February 2025, mandates that all packaging be recyclable by 2030 and restricts void space, including foam fill—to a maximum of 50% to reduce over-packaging.

- Plastic Waste Management (Amendment) Rules 2025 (India): These updated rules require all plastic packaging to feature machine-readable QR codes or barcodes by July 2025 to ensure full traceability and accountability throughout the product’s lifecycle.

- State-Level Expanded Polystyrene (EPS) Bans (USA): In 2025, multiple U.S. states including California, Delaware, and Oregon implemented total bans on EPS foam food service containers and packaging peanuts to drive the adoption of compostable and bio-based alternatives.

- Plastic Industry Subsidy 2025 (India): This revised scheme provides MSMEs with capital subsidies of up to 30% for setting up new biodegradable plastic production units and offers interest subventions on loans to modernize green manufacturing.

- BioE3 Policy (India): Formally launched to foster “High Performance Biomanufacturing,” this policy establishes specialized “Biofoundries” and “Bio-AI Hubs” to accelerate the R&D and commercialization of high-value bio-based products like advanced bioplastic packaging.

Market Opportunities

- Rising consumer and regulatory demand for biodegradable and compostable packaging solutions.

- Expansion of e-commerce is increasing the need for protective, lightweight packaging alternatives.

- Growth in the food & beverage sector is seeking non-toxic, eco-friendly foam options

- Adoption by electronics and fragile goods manufacturers for sustainable protective packaging.

- Increasing investment in renewable raw materials (e.g., plant starches, PLA, PHA) for biofoam production.

- Development of value-added, customizable packaging with branding and design flexibility.

- Partnerships and collaborations between startups and established packaging firms to scale innovative technologies.

Segmental Insights

By Type

Starch based biofoam segment dominated the biofoam packaging market, motivated by its biodegradability, abundance of raw materials, and economic manufacturing. It is widely used in protective and food-contact applications as a sustainable substitute for traditional plastic foams. Strong regulatory pressure to cut down on plastic waste contributes to the predominance of biofoam solutions based on starch.

The polyhydroxyalkanoates (PHA)-based biofoam segment is growing rapidly, motivated by its superior performance and composability qualities. When compared to other bio-based materials, PHA-based foams have superior strength and moisture resistance. The commercial adoption of PHA-based biofoam is accelerated by rising investments in bio-polymer technologies.

By Application

The protective & cushioning packaging segment dominated the biofoam packaging market, motivated by the growing need for environmentally friendly shock-absorbing materials. Biofoam is frequently used to safeguard delicate items while they are being transported and stored. Segment dominance is strengthened by the trend toward environmentally friendly packaging in consumer goods and electronics logistics.

Foodservice & disposable food packaging segment fastest growing, driven by the growing use of compostable tableware and food containers. For single-use applications, biofoam provides food safety compliance and heat resistance. Demand in this market is rising dramatically as polystyrene food packaging is becoming increasingly prohibited.

By Foam

The molded foam inserts/parts segment dominated the biofoam packaging market, motivated by its exceptional product protection and personalized fit. These foams are frequently utilized in industrial packaging, appliances, and electronics. Widespread adoption is supported by their capacity to improve protection while consuming less material.

The loose-fill, peanuts, and pads segment is growing rapidly, driven by increasing demand for lightweight and void-filling packaging solutions. Bio-based loose-fill materials are preferred for their composability and ease of disposal. Rising e-commerce shipping volumes are further fueling growth in this segment.

By End User Industry

The e-commerce & retail packaging segment dominated the biofoam packaging market, driven by the need for environmentally friendly protective packaging and large package volumes. Bioform complies with environmental regulations and guarantees safe delivery. Online retail platforms are adopting green packaging at a faster rate thanks to brand focus.

The food & beverage segment is growing rapidly, driven by rising consumption of ready-to-eat meals and takeaway food products. Biofoam packaging supports temperature retention and hygiene standards. Growing consumer preference for eco-friendly food packaging is strengthening market growth.

More Insights of Towards Packaging:

- Agriculture Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Water-Soluble Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Retort Packaging Market Size, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Ready-To-Eat Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Mushroom Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Ready-To-Drink Packaging Market Size, Segments, Manufacturers, Value Chain and Competitive Analysis

- Modified Atmosphere Packaging (MAP) Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Metal Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Sachet Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Plastic Packaging Market Size, Segment Data, Regional (NA/EU/APAC/LA/MEA), Companies, Trade Data, Manufacturers & Suppliers 2035

- Antimicrobial Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Active Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Edible Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Corrugated Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Cosmetic Packaging Market Trends, Size, Segmentation, Regional Outlook, Competitive Landscape & Trade Analysis 2024-2035

- Pet Food Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Green Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Glass Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Seafood Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Aluminium Foil Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

By Region

Asia Pacific Leads the Way in Sustainable Packaging: Biofoam Market Dominance on the Rise

The Asia Pacific region dominated the market, driven by growing sustainability initiatives and manufacturing activity. Strong demand is supported by the quick expansion of e-commerce and food delivery services. Regional market leadership is being strengthened by government regulations that support biodegradable materials.

China Biofoam Packaging Market Trends

China’s market is growing strongly as sustainability becomes a central priority for regulators, brands, and consumers, particularly in the context of broader biodegradable and bio-based packaging growth. China’s market for biodegradable packaging overall is expanding rapidly across food service, retail, logistics, and e-commerce sectors, driven by stricter regulations against single-use plastics and rising consumer awareness of environmental issues, which encourages the adoption of compostable and bio-based materials like PLA and PBAT in flexible and rigid formats.

North America Surges Ahead: Biofoam Packaging Industry Records Fastest Growth

The North America region is growing rapidly, driven by stringent environmental laws and the growing use of compostable packaging. Strong demand from the online and foodservice industries encourages growth. The region’s use of bioform is growing as consumers become more conscious of plastic pollution.

U.S. Biofoam Packaging Market Trends

The U.S. market is growing as manufacturers and brands increasingly seek sustainable alternatives to traditional petroleum-based foams like expanded polystyrene (EPS) and polyethylene, driven by environmental concerns, regulatory pressures, and rising consumer demand for eco-friendly packaging. Biofoam materials, such as plant-based foams, starch-based foams, and biodegradable biopolymer blends, are being adopted across protective packaging, cushioning for electronics and fragile goods, and specialty food packaging where shock absorption and lightweight performance are important.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results – schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Developments in the Biofoam Packaging Industry:

- In March 2025, Woamy launched cellulose-based recyclable and biodegradable biofoam at Packaging Première & PCD Milan 2025. The product targets protective packaging applications with improved recyclability and composability.

- In August 2025, Bioplastics Innovation Hub & Cass Materials announced wheat straw-based biodegradable biofoam seafood boxes. These biofoam boxes aim to reduce EPS waste in the seafood supply chain while supporting circular packaging goals.

Top Companies in the Biofoam Packaging Market & Their Offerings:

- BASF SE: Produces certified compostable particle foams made from bio-based polymers for heavy-duty protective packaging.

- Sealed Air Corporation: Manufactures high-performance cushioning materials using sustainable, plant-based, and recycled content.

- Stora Enso: Develops renewable wood-fiber foams designed to be fully recyclable within standard paper waste streams.

- NatureWorks LLC: Supplies plant-derived PLA resins used to create biodegradable foam alternatives to traditional plastics.

- Synbra Technology: Created the first CO2-neutral expandable foam made entirely from organic plant-based materials.

Other Players

- Stora Enso

- Huntsman Corporation

- Cargill, Incorporated

- BEWi Group

- Novamont

- Total Corbion PLA

- Woodbridge Foam Corporation

- Eco-Global Manufacturing

- GreenCell Foam (KTM Industries)

- Ecovative Design LLC

Segments Covered in the Report

By Type

- Starch-based Biofoam

- Thermoplastic Starch (TPS) Foams

- Starch–PLA Blends

- Polylactic Acid (PLA)-based Biofoam

- Pure PLA Foams

- PLA–Plasticizer Blends

- Polyhydroxyalkanoates (PHA)-based Biofoam

- PHB (polyhydroxybutyrate) Foams

- PHBV and Copolymer Foams

- Mycelium-based Biofoam

- Grown Mycelium Blocks

- Mycelium Molded Parts

- Cellulose / Nanocellulose Foams

- Microfibrillated Cellulose Foams

- Cellulose Aerogels

- Bagasse / Sugarcane Fiber Foams

- Molded Bagasse Foam

- Bagasse Composite Foam

- Protein-based & Other Biopolymer Foams

- Soy/Casein-based Foams

- Alginates / Chitosan Foams

By Application

- Protective & Cushioning Packaging

- Electronics cushioning inserts

- Appliance and glassware protection

- Foodservice & Disposable Food Packaging

- Clamshells and trays

- Takeaway containers and cups

- Thermal / Insulative Packaging

- Cold-chain inserts

- Insulating liners and shippers

- E-commerce & Transit Void-fill

- Loose-fill peanuts and pads

- Molded parcel inserts

- Cosmetics & Personal Care Packaging

- Protective inserts for bottles/jars

- Gift-box cushioning

- Industrial & Heavy Equipment Packaging

- Pallet dunnage and blocking

- Heavy-part molded supports

- Others (Medical devices, Specialty)

- Sterile device transit supports

- Custom specialty applications

By Form

- Molded Foam Inserts / Parts

- Loose-fill / Peanuts / Pads

- Foam Sheets / Rolls / Liners

- Foam Trays & Clamshells

- Blocks & Cut-to-size Foam

- Pelletized / Injection-molded Foam Components

By End-User Industry

- E-commerce & Retail Packaging

- Online retailers

- Third-party logistics (3PL) providers

- Food & Beverage (Foodservice, Packaged Foods)

- Quick-service restaurants

- Packaged food brands

- Electronics & Consumer Durables

- Consumer electronics manufacturers

- Home appliance OEMs

- Household & Industrial Cleaning

- Fragile cleaning-product packaging

- Detergent/consumer goods brands

- Healthcare & Medical Devices

- Medical device manufacturers

- Pharmaceutical cold-chain support

- Automotive & Industrial Manufacturing

- Parts suppliers

- OEM spare-part packaging

- Others (Cosmetics, Luxury goods, Construction)

- Cosmetic brands

- Specialty industrial uses

By Region

North America

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5878

Request Research Report Built Around Your Goals: [email protected]

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards ICT | Towards Dental | Towards EV Solutions | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Towards Packaging Releases Its Latest Insight – Check It Out:

- Packaging Waste Management Market Size, Segments and Regional Data (NA/EU/APAC/LA/MEA) 2025-2035

- Packaging Materials Market Size, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- U.S. Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Automated Bagging Solutions Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Automotive Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Frozen Food Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Smart Packaging Market Size, Share, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, and Value Chain Analysis, 2025-2035

- Intelligent Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Reusable Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- E-Commerce Packaging Market Size, Share, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), and Competitive Analysis 2025-2035

- Pharmaceutical Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Flexible Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Recyclable Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Pharmaceutical Temperature Controlled Packaging Solutions Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Rigid Plastic Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Protective Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- AI in the Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Eco-friendly Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Ampoules Packaging Market Size, Segments, Regional Data and Competitive Insights (2025-2035)

- 3D Rendering Market Size, Segment Data, Regional Insights, Companies, Value Chain & Trade Analysis (2025-2035)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. DailyIndiaNews.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. DailyIndiaNews.com takes no editorial responsibility for the same.