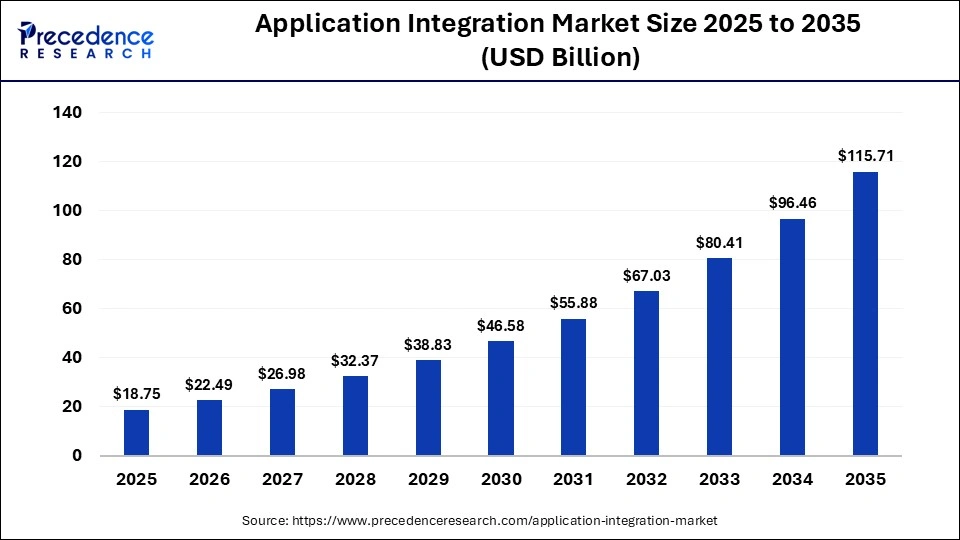

Application Integration Market Size to Surpass USD 115.71 Billion by 2035

According to Precedence Research, the global application integration market size was calculated at USD 18.75 billion in 2025 and is predicted to increase from USD 22.49 billion in 2026 to approximately USD 115.71 billion by 2035, expanding at a CAGR of 19.96% from 2026 to 2035. The rapid growth in digital transformation and high demand for data-driven decision drives the market growth.

Ottawa, Feb. 03, 2026 (GLOBE NEWSWIRE) — Growing adoption of cloud computing and the need for seamless data connectivity across enterprise applications are fueling growth in the Application Integration market.

What is the Application Integration Market Size in 2026?

The global application integration market size is calculated at USD 22.49 billion in 2026 and is predicted to reach around USD 115.71 billion by 2035, expanding at a CAGR of 19.96% from 2026 to 2035.

Application Integration Market Key Highlights

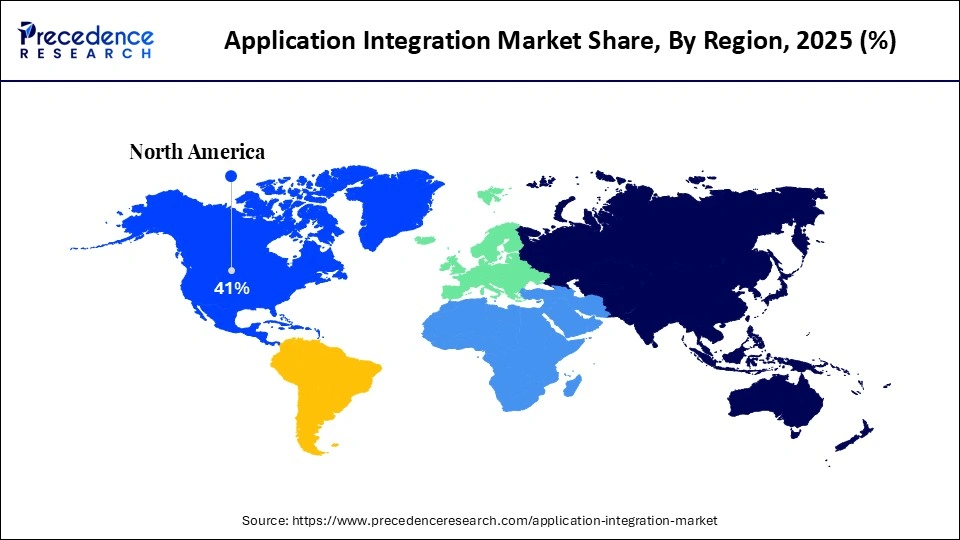

- North America dominated the application integration market, accounting for the largest revenue share of 41% in 2025.

- Asia Pacific is expected to register the fastest growth over the forecast period.

- By offering, the platforms segment held the leading market share in 2025.

- The services segment is projected to grow at the highest rate during the forecast period.

- By deployment, cloud-based solutions led the market in 2025.

- The on-premises segment is anticipated to expand at a notable CAGR throughout the forecast timeframe.

- By organization size, large enterprises accounted for the largest market share in 2025.

- The SME segment is expected to witness the fastest growth in the coming years.

- By integration type, Integration Platform as a Service (iPaaS) dominated the market in 2025.

- The hybrid integration segment is forecast to experience the highest growth rate over the projected period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/7462

What is Application Integration?

The application integration market growth is driven by increasing investment in digital transformation, growing use of SaaS applications, focus on real-time data sharing, increasing use of EHR integration in the healthcare industry, rise in business operation automation, growth in hybrid environments, and increased use of AI-enabled workflows.

Application integration is the process of connecting independently designed software applications to automate processes. It supports automatic data sharing and develops seamless workflows. The technologies used for application integration are middleware, messaging protocols, APIs, and iPaaS. It offers benefits like automating tasks, providing better insights, enabling personalized customer experience, and digital transformation.

Private Industry Investments for Application Integration

- IBM’s Acquisition of Confluent: IBM proposed an $11 billion acquisition of Confluent in 2025 to build a “smart data platform” that connects and governs data for AI agents and applications.

- CData Software Series C Round: CData Software secured a $510 million Series C round in June 2024, led by Updata Partners and Accel, to expand its no-code data and application integration tools.

- Hightouch Series C Funding: In July 2025, Hightouch raised additional capital in a Series C round to enhance its AI-driven marketing and real-time data integration platform.

- Estuary Series A Funding: Estuary raised $24 million in a Series A round in October 2025 to advance its data-warehouse management and real-time pipeline analysis solutions.

- Enerzolve Seed Funding: In January 2026, Enerzolve raised $5.1 million in a seed round led by Jungle Ventures to develop its AI-focused integration infrastructure.

- Silver Lake’s Acquisition of Software AG: Silver Lake acquired Software AG to focus on its modernization and hybrid-cloud integration capabilities through its established webMethods integration platform.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Key Trends of the Application Integration Market

- Agentic AI Integration: Platforms are becoming the backbone for autonomous agents to execute complex workflows across various enterprise systems. These systems provide the real-time data context necessary for AI to perform end-to-end business tasks securely.

- Low-Code Democratization: Most new enterprise apps are now built using low-code tools to combat the global developer shortage. This shift allows non-technical employees to automate their own workflows, significantly outnumbering professional developers.

Built for leaders who move markets. Access live, actionable intelligence with Precedence Q. https://www.precedenceresearch.com/precedenceq/

Market Opportunity

Growing Digital Transformation

The focus on lowering manual workflows in businesses and the increasing digital transformation in business operations increase demand for application integration. The need for creating unified views of business operations and the increased use of cloud software increase demand for application integration. The faster adoption of new digital services requires application integration.

The growth in workflow automation and the proliferation of connected devices increases demand for application integration. The focus on offering personalised customer experiences and managing a vast amount of data requires application integration. The growing digital transformation creates an opportunity for the growth of the application integration industry.

Get informed with deep-dive intelligence on AI’s market impact https://www.precedenceresearch.com/ai-precedence

Application Integration Market Report Coverage

| Report Coverage | Details |

| Market Size in 2025 | USD 18.75 Billion |

| Market Size in 2026 | USD 22.49 Billion |

| Market Size by 2035 | USD 115.71 Billion |

| Market Growth (2026 – 2035) | 19.96% CAGR |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Offering, Deployment, Organization Size, Integration Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

➤ Access the Full Application Integration Market Study @ https://www.precedenceresearch.com/application-integration-market

Regional Insights

What is the North America Application Integration Market Size in 2026?

The North America application integration market size is evaluated at USD 9.22 billion in 2026 and is predicted to reach approximately USD 48.02 billion by 2035, with a 20.10% CAGR from 2026 to 2035.

North America dominated the market with a 41% share in 2025. The heavy investment in digital transformation and the growing expansion of the BFSI sector increase demand for application integration. The presence of multi-cloud environments and the growing cloud deployment in businesses increases the adoption of application integration.

The well-established telecon industry and the increasing investment in data centers require application integration. The presence of companies like Microsoft, Salesforce, IBM Corporation, and Oracle drives the market growth.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/7462

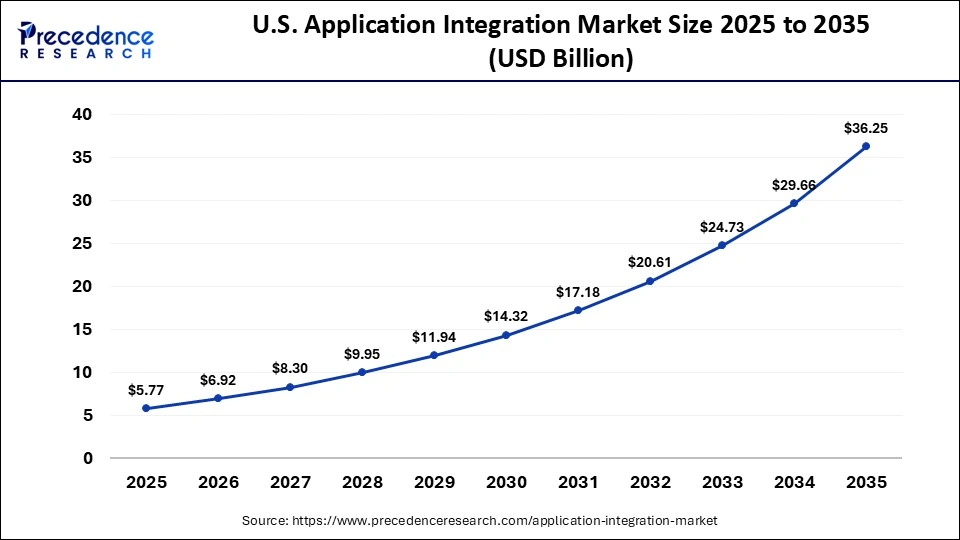

What is the U.S. Application Integration Market Size in 2026?

The U.S. application integration market size is accounted at USD 6.92 billion in 2026 and is expected to attain around USD 36.25 billion in 2035, accelerating at a strong CAGR of 20.17% between 2026 and 2035.

U.S. Application Integration Market Trends

The U.S. market is being driven by rapid cloud adoption, with organizations prioritizing hybrid and multi-cloud integration to connect legacy systems with modern SaaS platforms. Demand is growing for low-code and no-code integration tools as businesses seek faster deployment and reduced reliance on specialized developers.

How is the Asia Pacific experiencing the Fastest Growth in the Application Integration Market?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The increasing investment in digital transformation and the growing industrial automation increases demand for application integration. The expansion of 5G technology and the rapid growth in e-commerce increase demand for application integration.

The strong presence of smart manufacturing and the ongoing modernization of payments increases the adoption of application integration. The increased cloud adoption supports the overall market growth.

Japan Application Integration Market Trends

Japan’s market is expanding as enterprises increasingly adopt cloud-based and hybrid integration platforms to connect legacy systems with modern SaaS and on-premises applications, reflecting broader digital transformation efforts. The rise of API-driven development and a growing API ecosystem are key trends, with organizations leveraging APIs for seamless interoperability and enhanced service delivery across industries.

Application Integration Market Segmentation

Offering Insights

Why Platforms Segment Dominated the Application Integration Market?

The platforms segment dominated the market in 2025. The push for cloud-based iPaaS and the strong focus on creating integrations independently increase demand for platforms. The high transaction volume in the BFSI sector and the focus on real-time data synchronization increase demand for platforms. The superior connectivity, improved operational efficiency, and compatibility of platforms drive the market growth.

The services segment is the fastest-growing in the market during the forecast period. The increased use of specialized SaaS apps and the focus on automating workflows in businesses increase demand for services. The increasing need for better customer experience and the rise of integration of AI into workflows increase demand for services. The growing need for specialized consulting supports the overall market growth.

Deployment Insights

How did the Cloud Segment hold the Largest Share in the Application Integration Market?

The cloud segment held the largest share in the market in 2025. The growing expansion of cloud-based software and the growth in remote work capabilities help market expansion. The strong focus on seamless data transfer and the transition towards digital models increases demand for the cloud. The cost-effectiveness, high scalability, superior flexibility, and excellent performance of cloud drive the market growth.

The on-premises segment is experiencing the fastest growth in the market during the forecast period. The strong focus on protecting systems against external threats and the stricter regulations for data residency increase demand for on-premises deployment. The high data security, superior stability, privacy, and excellent security in on-premises environments support the overall market growth.

Organization Size Insights

Which Organization Size Segment Dominated the Application Integration Market?

The large enterprises segment dominated the market in 2025. The growing manufacturing operations and the investment in the development of scalable enterprise solutions increase demand for application integration. The need for enhancing operational efficiency and the strong focus on operating on-premises software increase the demand for application integration. The large-scale digital transformation in large enterprises drives the overall market growth.

The SME segment is the fastest-growing in the market during the forecast period. The increased utilization of cloud-based platforms and the focus on improving customer engagement in the SME help market expansion. The strong government focus on digitalization and on real-time business decisions increases the adoption of application integration. The need for eliminating data silos and the proliferation of SaaS support the overall market growth.

Integration Type Insights

How did the Integration Platform as a Service (iPaaS) Segment hold the Largest Share in the Application Integration Market?

The Integration Platform as a Service (iPaaS) segment held the largest share in the market in 2025. The focus on lowering integration time and the popularity of subscription-based services increase demand for iPaaS. The need for automating manual tasks and the rapid growth in the banking sector increases adoption of iPaaS. The lower cost, improved user experience, agility, and high scalability of iPaaS drive the overall market growth.

The hybrid integration segment is experiencing the fastest growth in the market during the forecast period. The focus on securing integration in public cloud systems and the need for optimizing workloads increase demand for hybrid integration. The growing use of ML in businesses and the growth in Citizen Integrators increases adoption of hybrid integration. The data security, low-code, and operational flexibility of hybrid integration support the overall market growth.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/7462

Top Companies in the Application Integration Market & Their Offerings:

- Salesforce: Offers MuleSoft, a platform for building and managing API-led connectivity across hybrid environments.

- IBM: Provides App Connect, using AI-powered automation to integrate applications and data across cloud and on-premise systems.

- SAP SE: Delivers the Integration Suite, an iPaaS designed to unify business processes across SAP and third-party ecosystems.

- Oracle: Features Oracle Integration Cloud, which automates end-to-end business processes by connecting disparate enterprise applications.

- Microsoft: Offers Azure Logic Apps, a low-code cloud service for creating automated workflows that integrate apps and data.

- Informatica: Provides Intelligent Cloud Services, an AI-driven platform for enterprise-scale data integration and API management.

- Dell Boomi: Offers a low-code Enterprise Platform that simplifies connecting cloud and on-premises applications.

- SnapLogic: Utilizes an “Intelligent Integration” architecture to automate data flows using pre-built connectors called Snaps.

- Workato: Provides a low-code automation platform that uses “recipes” to integrate apps and orchestrate complex business workflows.

- TIBCO Software: Delivers TIBCO Cloud Integration, focusing on real-time connectivity and process automation for data-heavy enterprises.

Recent Developments in the Application Integration Industry

- In January 2026, LEAP Legal Software launched integration with Lawmatics to streamline law firms’ client data management. The integration automatically pushes documents, mapped fields, client details, and notes. The integration maintains data integrity and simplifies everyday legal work. (Source:- https://www.prnewswire.com)

- In January 2026, FreeAgent and Fathom launched a new integration for accountants. The integration provides access to KPI dashboards, real-time loss or profit reporting, and cash flow forecasting for users. It provides advisory insights and multi-client management support for accountants. (Source:- https://fintech.global)

Segments Covered in the Report

By Offering

- Platforms

- Services

- Professional Services

- Managed Services

By Deployment

- Cloud

- On-premises

By Organization Size

- Large Enterprises

- SMEs

By Integration Type

- Point-To-Point Integration

- Enterprise Application Integration

- Enterprise Service Bus

- Integration Platform as a Service

- Hybrid Integration

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/7462

You can place an order or ask any questions, please feel free to contact at [email protected] | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Chem and Materials | Towards FnB | Statifacts | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. DailyIndiaNews.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. DailyIndiaNews.com takes no editorial responsibility for the same.