Diaper Packaging Market Trends 2026-2035

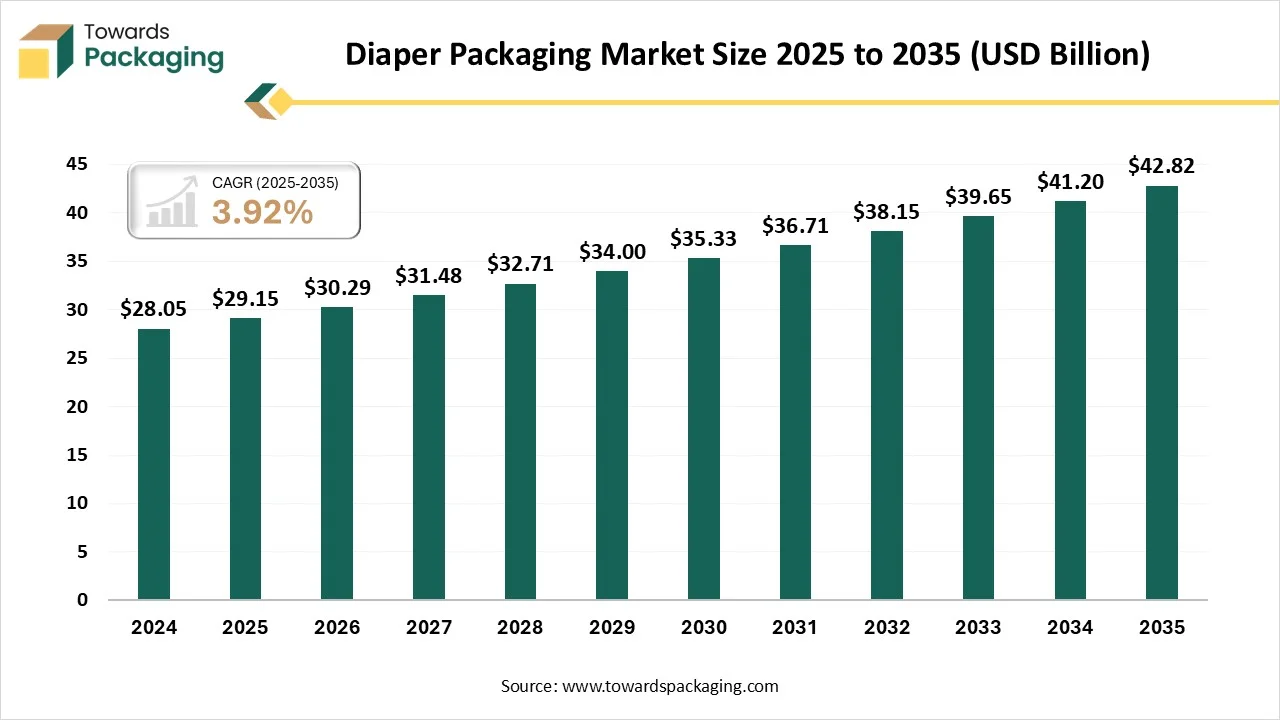

According to Towards Packaging consultants, the global diaper packaging market is projected to reach approximately USD 42.82 billion by 2035, increasing from USD 29.15 billion in 2025, at a CAGR of 3.92% during the forecast period 2026 to 2035.

Ottawa, Jan. 22, 2026 (GLOBE NEWSWIRE) — The global diaper packaging market stood at USD 29.15 billion in 2025 and is projected to reach USD 42.82 billion by 2035, according to a study published by Towards Packaging, a sister firm of Precedence Research. The diaper packaging market is witnessing steady growth, driven by rising infant birth rates, increasing adult incontinence awareness, and growing demand for hygienic, convenient packaging solutions. Manufacturers are focusing on durable, lightweight, and moisture-resistant packaging to protect product quality and enhance shelf appeal.

Request Research Report Built Around Your Goals: [email protected]

What is Meant by the Diaper Packaging Market?

Diaper packaging refers to the materials, formats, and design solutions used to protect, store, transport, and present baby and adult diapers from manufacturing to end use. It includes primary and secondary packaging such as plastic films, pouches, bags, and cartons that ensure hygiene, prevent moisture damage, and maintain product integrity. Diaper packaging also supports branding, regulatory labeling, convenience features like easy-carry handles, and sustainability initiatives such as recyclable or reduced-material packaging.

Private Industry Investment for Diaper Packaging:

- Neo Asset Management invested $20 million (₹170 crore) in Nobel Hygiene in May 2025 to scale the distribution and brand presence of their adult and baby diaper lines, which use advanced leak-protection packaging.

- Bharat Value Fund (BVF), managed by Pantomath Capital, closed a ₹122 crore private placement round in Millennium Babycares in October 2024 to fund market expansion for their hygiene care products.

- JM Financial Private Equity finalized a ₹60 crore investment in Canpac Trends, a leading folding carton and packaging solutions company, to augment existing capacities for organized retail and hygiene packaging.

- Mondi Group and Amcor have made substantial R&D investments in sustainable diaper packaging, such as Mondi’s paper-based EcoWicketBag for Drylock Technologies and Amcor’s recycled content bags for Huggies, aiming to reduce CO2 footprints in the hygiene sector.

- Oji Holdings Corporation has deployed significant private capital to expand its manufacturing facilities in India, including a new factory in Sri City in 2024, specifically for fiberboard and corrugated packaging used in diaper distribution.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5920

What Are the Latest Key Trends in the Diaper Packaging Market?

1. Sustainable & Eco-Friendly Packaging

The shift toward biodegradable, compostable, and recyclable materials is a major trend as environmentally conscious consumers seek greener options. Brands are reducing plastic use, adopting paper-based wraps, plant-based inks, and other eco alternatives that lower environmental impact while still protecting diapers during transport and storage.

2. Smart Packaging Technologies

Manufacturers are integrating smart features like QR codes, RFID tags, and interactive elements to enhance consumer engagement and traceability. These technologies provide product information, authenticity checks, and even digital experiences that foster brand loyalty and improve supply chain monitoring.

3. Convenience-Focused Designs

Parents favor packaging that is easy to open, resealable, and portable. Trends include ergonomic shapes, travel-friendly packs, compact sizes, and user-centric features like easy-carry handles and simple closures that make diaper changes and storage more efficient for caregivers.

4. Customization & Personalization

Personalized packages with themed graphics, limited-edition designs, or tailored branding help diapers stand out on shelves and appeal to specific consumer groups. Customization also extends to subscription and bundle packaging that matches customer preferences for recurring deliveries.

5. E-commerce & Subscription-Ready Packaging

With the rise of online diaper purchases, packaging is being optimized for e-commerce durability, shelf visibility, and subscription models. Boxes and cartons designed for safe delivery and easy storage are increasingly popular, supporting consumer demand for home delivery and regular refill services.

What is the Potential Growth Rate of the Diaper Packaging Industry?

The growth of the diaper packaging industry is driven by rising birth rates in developing regions, increasing awareness of infant hygiene, and growing adoption of adult incontinence products among aging populations. Expanding urbanization and higher disposable incomes are boosting demand for branded diapers with high-quality packaging. The rapid growth of e-commerce and organized retail is increasing the need for durable, lightweight, and transport-friendly packaging solutions.

Additionally, innovation in sustainable and recyclable materials, along with regulatory focus on safe and hygienic packaging, is further supporting market growth globally.

More Insights of Towards Packaging:

- Industrial Foam Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Disposables Packaging Market Size, Share, Trends, and Forecast Analysis, 2025-2035

- Laminated Tubes Market Size and Segments Outlook (2026–2035)

- Collapsible Rigid Containers Market Size and Segments Outlook (2026–2035)

- Cosmetic Tubes Market Size and Segments Outlook (2026–2035)

- Plastic Bag Market Size and Segments Outlook (2026–2035)

- 3D CAD Software Market Size, Trends and Segments (2026–2035)

- Plastic Recycling Services Market Size, Trends and Regional Analysis (2026–2035)

- 3D Semiconductor Packaging Market Size and Segments Outlook (2026–2035)

- Battery Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Hot-fill Food Packaging Market Size and Segments Outlook (2026–2035)

- Flexible Paper Packaging Market Size and Segments Outlook (2026–2035)

- Vaccine Packaging Market Size, Trends and Regional Analysis (2026–2035)

- 3D Rendering Market Size, Trends and Segments (2026–2035)

- Pharmaceutical and Chemical Aluminum Bottles and Cans Market Size, Trends and Segments (2026–2035)

- Labeling Machine Market Size, Trends and Segments (2026–2035)

- Stand-Up Pouch Market Size, Trends and Competitive Landscape (2026–2035)

- Fiber Trays for Meal Packaging Market Size, Trends and Segments (2026–2035)

- Sustainable Retail Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- U.S. 503B Compounding Pharmacy Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2026-2035

Regional Analysis:

Who is the leader in the Diaper Packaging Market?

North America dominates the market due to high consumption of baby and adult diapers, driven by strong hygiene awareness and an aging population. The region benefits from the presence of leading diaper and packaging manufacturers, advanced packaging technologies, and well-established retail and e-commerce channels. Additionally, growing demand for sustainable, convenient, and premium packaging solutions further strengthens regional market leadership.

U.S. Diaper Packaging Market Trends

The U.S. dominates the North American market due to high diaper usage across the infant and adult segments, strong presence of global diaper brands, and advanced packaging infrastructure. Widespread adoption of sustainable packaging, robust e-commerce penetration, and high consumer spending on hygiene products further support the country’s leading position.

What is the opportunity in the Rise of the Asia Pacific in the Diaper Packaging Industry?

The Asia-Pacific region is the fastest-growing market for diaper packaging due to rising birth rates, increasing population, and growing awareness of infant hygiene. Rapid urbanization, expanding middle-class income, and increasing adoption of baby and adult diapers are boosting demand. Additionally, the growth of e-commerce and the improvement of retail infrastructure are accelerating packaging requirements across the region.

China Diaper Packaging Market Trends

China dominates the Asia-Pacific market due to its large population base, high birth numbers, and rapidly expanding middle-class consumer segment. Strong domestic diaper manufacturing, cost-effective packaging production, and increasing adoption of hygienic baby and adult incontinence products support growth. Additionally, well-developed e-commerce platforms and large-scale retail networks strengthen China’s market leadership.

How Big is the Success of the European diaper Packaging Industry?

Europe’s market is propelled by strong consumer demand for sustainable, eco-friendly materials amid strict EU waste and plastic regulations, heightened hygiene awareness, expanding e-commerce and online distribution, and the dual pressure of both rising birth rates and an aging population, increasing adult incontinence product needs.

The UK Diaper Packaging Market Trends

The UK is growing fastest in the European market due to strong consumer demand for sustainable, eco-friendly materials and innovation in biodegradable and recyclable solutions, rising awareness of hygiene and skin-sensitive products, expanding e-commerce and subscription channels, and a well-developed retail infrastructure that supports premium and convenience-driven offerings.

How Crucial is the Role of Latin America in the Diaper Packaging Industry?

The Latin American market is growing due to rising birth rates and expanding middle-class incomes, boosting demand for baby and adult incontinence products, increased hygiene awareness, and broader retail/e-commerce distribution. Manufacturers are also shifting to sustainable, eco-friendly packaging in response to environmental concerns and regional regulatory trends, while localized production improves accessibility and competitiveness.

How Big is the Opportunity for the Growth of the Middle East and Africa Diaper Packaging Industry?

The Middle East and Africa market presents significant growth potential as rising birth rates, urbanization, and expanding disposable incomes drive higher demand for infant and adult hygiene products. Improving retail infrastructure, increasing awareness of modern hygiene practices, and focusing on affordable, innovative packaging solutions by global and local players also support future expansion.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results – schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Outlook

Material Type Insights

What made the Plastic Segment Dominant in the Diaper Packaging Market in 2024?

The plastic segment dominates diaper packaging because plastics like polyethylene and polypropylene are cost-effective, lightweight, durable, and offer superior moisture-barrier protection that preserves hygiene and product integrity. These materials are easily formed into varied shapes and allow clear branding and flexible designs, making them the preferred choice for manufacturers over alternatives.

The biodegradable materials segment is growing fastest because rising environmental awareness and strict sustainability regulations are pushing consumers and brands toward eco-friendly packaging that reduces plastic waste. Advances in plant-based and compostable materials, plus consumer preference for green products that balance performance with reduced environmental impact, further accelerate adoption.

Packaging Type Insights

How the Flexible Packaging dominate the Diaper Packaging Market in 2024?

The flexible packaging segment dominates the market because it is lightweight, cost-efficient, and easy to handle, reducing logistics and material costs. Its multi-layer films provide strong moisture and contamination protection while supporting attractive branding and customization. These attributes enhance shelf appeal, convenience, and transport efficiency, making flexible packaging the preferred choice for diaper makers.

The semi-rigid packaging segment is growing fastest because it combines structural protection with lighter materials, enhancing product safety and shelf appeal. Its balanced rigidity helps prevent contamination and moisture damage during transport and storage, while offering improved consumer convenience and premium presentation that attract brands seeking differentiation and stronger retail visibility.

Product Type Insights

Which Factors Make the Baby Diapers Segment the Dominant Segment in the Market in 2024?

The baby diapers segment dominates the market because consistently high birth rates and strong parental demand for convenience, hygiene, and comfort drive frequent purchases. Parents prioritize protective, easy-to-use, absorbent products, and innovations like wetness indicators and skin-friendly features further reinforce baby diapers’ leading position in packaging demand.

The adult diapers segment is the fastest-growing because expanding elderly populations and higher incontinence prevalence increase sustained demand, while product innovations such as improved comfort, discretion, absorbency, and odor-control features enhance user acceptance. Rising hygiene awareness, reduced stigma, and broader online and institutional distribution also boost adoption in both home care and healthcare settings.

End-User Insights

What made the Infant Care Segment Dominant in the Diaper Packaging Market in 2024?

The infant care segment dominates the market because high birth rates and frequent diaper use drive consistent demand. Parents prioritize hygiene, convenience, and protective features, prompting brands to invest in strong, user-friendly packaging. Additionally, rising disposable incomes and awareness of infant health boost premium and innovative packaging choices tailored to newborn needs.

The adult incontinence care segment is the fastest-growing because expanding elderly populations and rising prevalence of incontinence increase sustained demand for hygienic solutions, while reduced stigma and greater health awareness boost acceptance. Improved product comfort, discretion, and e-commerce accessibility make incontinence products easier to use and buy, broadening consumption beyond institutional settings into everyday home care.

Distribution Channel Insights

How do the Supermarkets & Hypermarkets dominate the Diaper Packaging Market in 2024?

The supermarkets & hypermarkets dominate the market because they offer one-stop, convenient shopping with extensive brand and product variety, competitive pricing, bulk purchase options, and strong in-store visibility. Their wide reach and promotional displays help consumers compare sizes and features easily, making them the preferred choice for most diaper buyers.

The online retail segment is the fastest growing in the market because rising internet and smartphone penetration make e-commerce more accessible, offering consumers convenient home delivery, wider product selection, competitive pricing, and subscription services. These digital advantages, along with targeted promotions and ease of comparison shopping, drive rapid growth in online diaper purchases.

Recent Breakthroughs in the Diaper Packaging Industry

- On January 6, 2026, Unicharm Corporation, a manufacturing company, announced a breakthrough dry-washing recycling technology designed to facilitate disposable diaper recycling with drastically reduced water usage. This advancement represents a significant step toward circular economy goals, enabling both product and packaging materials to be recycled more efficiently.

- On November 17, 2025, Pampers, a diaper manufacturing company, launched the world’s smallest diaper for extremely premature infants, introducing specialized fits for sensitive and delicate users. This product required innovative packaging adjustments to ensure safe handling, secure shipping, and hygienic presentation.

- On May 5, 2025, GreenCore Solutions Corp., a hygiene technology company based in Canada, launched full-scale production of its TreeFree Diaper in Europe. The product features a universal, sustainable packaging system designed to support private-label distribution across retail chains.

Top Companies in the Global Diaper Packaging Market & Their Offerings:

- Optima Packaging Group GmbH: Builds fully automatic systems that stack, compress, and bag diapers in PE film or paper.

- Curt G. Joa, Inc.: Engineers custom converting machinery that integrates high-speed manufacturing with automated product folding and packaging.

- Zuiko: Produces high-speed modular machines capable of precision folding and packaging over 1,000 diapers per minute.

- GDM: Offers integrated end-of-line solutions for stacking and bagging finished hygiene products at maximum production speeds.

- Favourite Fab: Provides third-party manufacturing services, including custom-branded packaging and bulk supply for private labels.

- Unicharm Corporation: Uses breathable, soft-touch packaging designed for premium retail appeal and moisture protection for Moony and MamyPoko.

- Kao Corporation: Focuses on hygienic, easy-to-handle packaging for its Merries brand to ensure product integrity and consumer convenience.

- Kimberly-Clark Corporation: Utilises ergonomic and increasingly sustainable materials for its Huggies and Depend retail packaging.

- Procter & Gamble Company: Employs logistically optimised, high-count packaging for Pampers to maximize shelf efficiency and bulk storage.

- Ontex Group NV: Specialises in cost-effective, flexible packaging designs for both international private labels and their own value brands.

Segment Covered in the Report

By Material

- Plastic

- Paper & Paperboard

- Biodegradable Materials

By Packaging Type

- Flexible Packaging

- Rigid Packaging

- Semi-Rigid Packaging

By Product Type

- Baby Diapers

- Training Pants

- Adult Diapers

By End Use

- Infant Care

- Toddler Care

- Adult Incontinence Care

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Pharmacies

- Online Retail

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5920

Request Research Report Built Around Your Goals: [email protected]

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight – Check It Out:

- Certified-Circular Polyethylene (PE) Market Size and Segments Outlook (2026–2035)

- High-Quality Rigid Packaging Materials Market Size, Trends and Regional Analysis (2026–2035)

- Molded Pulp Packaging Market Size, Trends, Segments, Regional Outlook & Competitive Landscape Analysis

- Peelable Lidding Films Market Size, Trends and Competitive Landscape (2026–2035)

- Foam Protective Packaging Market Size, Share, Trends, and Forecast Analysis (2025-2035)

- Solid Bleached Sulfate (SBS) Board Market Size, Trends and Regional Analysis (2026–2035)

- PP Deli Food Container Market Size, Trends and Regional Analysis (2026–2035)

- Plastic Tubes Market Size, Trends and Competitive Landscape (2026–2035)

- Cork Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Medical Flexible Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Blood Glucose Test Strip Packaging Market Size and Segments Outlook (2026–2035)

- Aseptic Packaging for Non-Carbonated Beverages Market Size and Segments Outlook (2026–2035)

- Aluminum Tubes Market Size, Trends and Competitive Landscape (2026–2035)

- Shaped Corrugated Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Rigid IBC Market Size and Segments Outlook (2026–2035)

- Old Corrugated Container Market Size, Trends and Competitive Landscape (2026–2035)

- Luxury Rigid Box Market Size, Trends and Regional Analysis (2026–2035)

- Corrugated Bulk Bin Market Size, Trends and Segments (2026–2035)

- Rigid Food Packaging Market Size and Segments Outlook (2026–2035)

- Corrugated Wraps Market Size, Trends and Regional Analysis (2026–2035)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. DailyIndiaNews.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. DailyIndiaNews.com takes no editorial responsibility for the same.