Healthcare Insurance Market Size to Reach USD 4.56 Trillion by 2032 Owing to Rising Costs and Expanding Coverage | S&S Insider

U.S. Healthcare Insurance Market to Reach $1.63 Trillion by 2032 Due to Growing Demand for Mental Health and Tailored Insurance Plans.

Austin, Oct. 02, 2025 (GLOBE NEWSWIRE) — Healthcare Insurance Market Size & Growth Analysis:

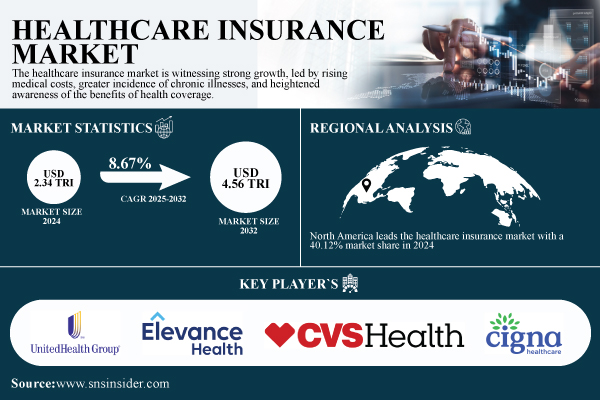

According to S&S Insider, the global Healthcare Insurance Market was valued at USD 2.34 trillion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 8.67%, reaching USD 4.56 trillion by 2032. The U.S. healthcare insurance market accounted for USD 0.85 trillion in 2024 and is expected to grow at an 8.47% CAGR, hitting USD 1.63 trillion by 2032. This robust growth is largely fueled by rising healthcare costs, increasing consumer awareness, and supportive government initiatives encouraging insurance coverage.

Get free Sample Report of Healthcare Insurance Market: https://www.snsinsider.com/sample-request/7149

High medical expenses have made out-of-pocket payments unaffordable for many, pushing more individuals and families toward insurance as protection against financial hardship. Notably, mental health coverage has gained prominence, demonstrated by a 41% increase in consumer interest between 2024 and 2025. Governments worldwide have also played a key role by introducing programs that improve access, such as Medicare and Medicaid in the U.S., and Ayushman Bharat in India, boosting both public and private market segments.

While rising premium costs remain a challenge, particularly for low- and middle-income households, the overall market trends reflect strong demand for comprehensive and affordable healthcare insurance products.

Major Players Analysis Listed in the Healthcare Insurance Market Report are

- UnitedHealth Group

- Elevance Health

- CVS Health

- Cigna Corporation

- Centene Corporation

- Humana Inc.

- Kaiser Permanente

- Health Care Service Corporation (HCSC)

- Allianz SE

- Zurich Insurance Group

- Other players

Healthcare Insurance Market Report Scope

| Report Attributes | Details |

| Market Size in 2024 | USD 1.85 trillion |

| Market Size by 2032 | USD 3.82 trillion |

| CAGR | CAGR of 9.43% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Regional Analysis | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Key Growth Drivers | Increasing Healthcare Costs Driving the Market Growth

Supportive Government Initiatives are Propelling the Market Growth |

Segmentation Analysis:

By Provider

The public provider segment led the healthcare insurance market share with 86.08% in 2024 due to the high incidence of government-supported insurance programs. The private segment is anticipated to register significant growth in the forecast period with a 9.2% CAGR. The segment’s growth propelled by growing demand for more tailored healthcare, shorter waiting lists, and complete coverage options that exceed the fundamental services provided by public insurance.

By Type

The life insurance segment dominated the healthcare insurance market with an 88.12% market share in 2024 due to its extensive history as a financial security building block. The term insurance segment is expected to witness the fastest growth in the forecast period with 9.69% CAGR, as more and more individuals choose cheap, short-term insurance.

By Plans

The preferred provider organization (PPO) segment dominated the health insurance market with a 48.20% market share in 2024, due to its flexibility and wide access to medical providers. The point of service (POS) segment is expected to experience the fastest growth during the forecast period as more customers need a mix of the convenience of PPOs and the affordability of Health Maintenance Organizations (HMOs).

By Level of Coverage

The silver segment led the healthcare insurance market with a 52.13% market share in 2024 due to its balanced premium and coverage design. The gold segment is projected to experience the fastest growth within the forecast years due to its greater coverage level, which is attractive to those willing to pay higher premiums for greater benefits and reduced out-of-pocket costs.

By Demographics

The adult segment dominated the healthcare insurance market with 72.25% market share in 2024, as this age group has the largest share of the working population. The seniors segment will exhibit the fastest growth in the projection years, as the global population getting older, especially in developed nations where the population of senior citizens is on the rise.

By End-use

The individual segment led the healthcare insurance market with a 68.06% market share in 2024 due to the growing number of self-employed workers, freelancers, and part-time workers looking for individual coverage plans. The corporate segment is anticipated to register the fastest growth in the forecast period, with an increased number of organizations enriching their employee benefits to poach and retain talent.

Need Any Customization Research on Healthcare Insurance Market, Enquire Now: https://www.snsinsider.com/enquiry/7149

Healthcare Insurance Market Key Segments

By Provider

- Public

- Private

By Type

- Life Insurance

- Term Insurance

By Plans

- Health Maintenance Organization (HMO) plans

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Point of Service (POS)

- High Deductible Health Plan (HDHP) plans

By Level of Coverage

- Bronze

- Silver

- Gold

- Platinum

By Demographics

- Minors

- Adults

- Seniors

By End-use

- Individuals

- Corporates

- Others

North America Held the Dominant Share of 40.12% in 2024; Asia Pacific is Expected to Witness Highest CAGR of 9.33% Over 2025-2032

North America leads the healthcare insurance market with a 40.12% market share in 2024, due to a fully established healthcare infrastructure, extensive availability of private and public insurance, and robust regulatory standards. Asia Pacific is the fastest-growing region in the healthcare insurance market analysis, with 9.33% CAGR, owing to the fast economic growth, growing healthcare awareness, and rising middle-class populations.

Recent News:

- November 2024 – UnitedHealthcare is expanding its Individual & Family Affordable Care Act (ACA) Marketplace plans significantly, now covering 30 states. The expansion also includes new markets in Indiana, Iowa, Nebraska, and Wyoming, as well as additional counties in 13 other states.

- February 2025 – Elevance Health, Inc. broadened its ACA products under the WellPoint brand to Florida, Maryland, and Texas for the 2025 coverage year. The company further improved its Medicare Advantage portfolio, with 90% of the offerings having zero monthly premiums and a primary emphasis on affordability.

Buy the Healthcare Insurance Market Report Now: https://www.snsinsider.com/checkout/7149

Exclusive Sections of the Report (The USPs):

- COVERAGE PENETRATION METRICS – helps you understand regional variations in healthcare insurance coverage, identifying high-growth markets and underinsured populations for strategic expansion.

- ENROLLMENT DYNAMICS – helps you track enrollment trends (2020–2024) across individual, group, and government plans, providing insights into consumer preferences and policy uptake patterns.

- PREMIUM GROWTH ANALYSIS – helps you evaluate premium escalation trends across various plan types, offering clarity on cost evolution, pricing strategies, and policyholder affordability.

- MARKET SHARE LANDSCAPE – helps you assess the competitive strength and market position of leading providers, enabling benchmarking and partnership or acquisition decisions.

- REGIONAL POLICY OUTLOOK – helps you uncover regional regulatory influences and government-led insurance programs shaping market penetration and public-private collaboration opportunities.

- DIGITAL ENROLLMENT & CLAIMS INDEX – helps you measure adoption of digital platforms for policy issuance, renewals, and claims management, indicating the maturity of tech integration within key markets.

Access Complete Report Details of Healthcare Insurance Market Analysis & Outlook: https://www.snsinsider.com/reports/healthcare-insurance-market-7149

[For more information or need any customization research mail us at [email protected]]

About Us:

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK) Email: [email protected]

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. DailyIndiaNews.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. DailyIndiaNews.com takes no editorial responsibility for the same.