Power T&D Equipment Market Size to Hit USD 317.36 Billion by 2033 | Research by SNS Insider

The U.S. Electric Power Transmission and Distribution Equipment Market is projected to grow from USD 32.19 billion in 2025E to USD 54.34 billion by 2032, registering 6.77% CAGR during 2026–2033. Growth is driven by rising electricity demand, grid modernization initiatives, renewable energy integration, and increased investment in advanced transformers, switchgear, meters, and automation across residential, commercial, and industrial sectors.

Austin, Jan. 21, 2026 (GLOBE NEWSWIRE) — Power T&D Equipment Market Size & Growth Insights:

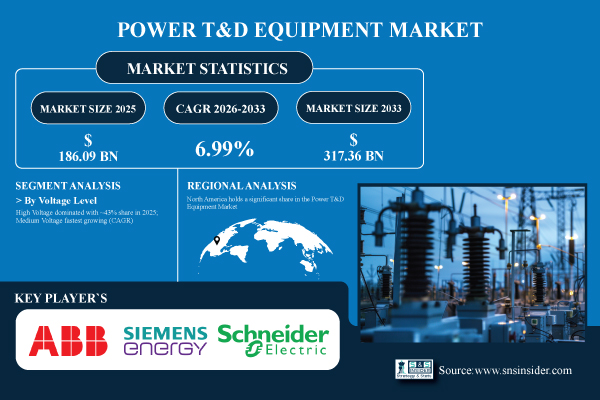

According to the SNS Insider, “The Power T&D Equipment Market Size is estimated at USD 186.09 billion in 2025 and is expected to reach USD 317.36 billion by 2033, growing at a CAGR of 6.99% from 2026-2033.”

Rapid Growth in Electricity Demand and Modernization of Power Infrastructure to Drive Market Growth Globally

Investments in power transmission and distribution infrastructure are increasing as a result of the growing demand for electricity from the commercial, residential, and industrial sectors. Utilities and governments are modernizing outdated networks with smart meters, switchgear, and sophisticated transformers. Improved transmission networks are necessary for the growth of renewable energy sources, such as wind and solar. Automation and high-efficiency equipment technological developments increase grid dependability and lower losses. Government incentives for smart grid implementation and growing electrification in developing nations are driving market expansion, guaranteeing the global adoption of Power T&D equipment and fostering long-term income development.

Market Size and Growth Projection

- Market Size in 2025: USD 186.09 Billion

- Market Size by 2033: USD 317.36 Billion

- CAGR: 6.99% from 2026 to 2033

- By Equipment, Transformers segment dominated in 2025

- Asia Pacific dominated the Market in 2025 with 45% share

Get a Sample Report of Power T&D Equipment Market Forecast @ https://www.snsinsider.com/sample-request/8753

Leading Market Players with their Product Listed in this Report are:

- ABB Ltd.

- Siemens Energy AG

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Eaton Corporation plc

- Hitachi Energy Ltd.

- General Electric (GE) Vernova

- Toshiba Energy Systems & Solutions

- Hyundai Electric & Energy Systems

- LS Electric Co., Ltd.

- Hyosung Heavy Industries

- CG Power & Industrial Solutions Ltd.

- Fuji Electric Co., Ltd.

- Powell Industries, Inc.

- Meidensha Corporation

- Socomec Group

- Hubbell Incorporated

- DMC Power

- Schneider Electric India

- Larsen & Toubro (L&T)

Power Transmission and Distribution Equipment Market Report Scope:

| Report Attributes | Details |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Equipment (Transformers, Switchgear, Cables and Wires, Meters, Insulators, Capacitors, Inductors, Others) • By Voltage Level (High Voltage, Medium Voltage, Low Voltage) • By Application (Transmission, Distribution, Substation Automation) • By End Use (Industrial, Commercial, Residential) |

Purchase Single User PDF of Power T&D Equipment Market Report (20% Discount) @ https://www.snsinsider.com/checkout/8753

Complex Regulatory Compliance and Stringent Safety Standards to Impede Market Growth Globally

Equipment used for power transmission and distribution must adhere to national and international standards for safety procedures, insulation, and voltage ratings. Project complexity is increased by compliance with grid dependability and environmental standards. Potential investors may become discouraged if implementation deadlines are prolonged due to delays in certifications and approvals. The strict inspection and testing procedures that utilities must follow raise operating expenses. The deployment of cross-border equipment may be hampered in emerging economies by the absence of standardized standards.

Key Segmentation Analysis

By End-Use

Industrial dominated with ~46% share in 2025 due to high electricity demand from manufacturing facilities, heavy industries, and large-scale operations. Commercial segment is expected to grow at the fastest CAGR from 2026-2033 due to the expanding urbanization, office complexes, and commercial establishments increase electricity demand.

By Voltage Level

High Voltage dominated with ~43% share in 2025 as transmission of large electricity loads over long distances requires reliable high-voltage transformers, switchgear, and lines. Medium Voltage segment is expected to grow at the fastest CAGR from 2026-2033 due to rising demand for efficient electricity distribution in urban and industrial areas.

By Equipment

Transformers dominated with ~29% share in 2025 owing to their essential role in stepping up and stepping down voltage for efficient transmission and distribution. Meters segment is expected to grow at the fastest CAGR from 2026-2033 as smart metering adoption increases for residential and commercial sectors.

By Application

Transmission dominated with ~42% share in 2025 due to critical need for transporting electricity over long distances with minimal losses. Substation Automation segment is expected to grow at the fastest CAGR from 2026-2033 due to modernization of electricity grids requires automated monitoring, control, and protection systems.

Regional Insights:

Asia Pacific dominated the Power T&D Equipment Market in 2025 with the highest revenue share of about 45% due to rapid industrialization, urbanization, and infrastructure expansion.

North America holds a significant share in the Power T&D Equipment Market due to well-established electricity infrastructure, high industrial and commercial power demand, and ongoing grid modernization projects.

Do you have any specific queries or need any customized research on Power T&D Equipment Market? Schedule a Call with Our Analyst Team @ https://www.snsinsider.com/request-analyst/8753

Recent Developments:

- 2025: ABB announced a USD 110 million investment in U.S. manufacturing to expand R&D and production of advanced electrification solutions, targeting increased demand from data centers and grid modernization.

- 2025: Schneider Electric launched the Ringmaster AirSeT, a next-generation SF₆-free medium-voltage switchgear, produced at its Leeds facility following a £7.2 million investment.

Exclusive Sections of the Power T&D Equipment Market Report (The USPs):

- URBAN VS. RURAL INSTALLATION SPLIT METRICS – helps you understand deployment concentration across urban and rural grids, supporting infrastructure planning and regional investment decisions.

- AVERAGE INSTALLATION TIME BY EQUIPMENT TYPE – helps you evaluate project execution efficiency and identify equipment categories causing deployment delays or cost overruns.

- GRID INTEGRATION SUCCESS RATE ANALYSIS – helps you assess how effectively newly installed T&D equipment integrates with existing grid infrastructure, reducing commissioning risks.

- AUTOMATED MONITORING & DIAGNOSTICS ADOPTION RATE – helps you track the penetration of digital tools that improve installation accuracy, commissioning speed, and early fault detection.

- DEPLOYMENT EFFICIENCY BENCHMARKING – helps you compare installation performance across regions, utilities, and project types to identify best practices and scalability gaps.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. DailyIndiaNews.com takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. DailyIndiaNews.com takes no editorial responsibility for the same.